ValOre Announces Option Agreement on Hatchet Lake Uranium Project, Athabasca Basin, Saskatchewan

November 10, 2021

Vancouver, B.C. – November 10, 2021 – ValOre Metals Corp. (“ValOre”, or the “Company”) (TSX-V:VO, OTC:KVLQF, Frankfurt: KEQ) today announced that it has entered into a definitive property option agreement with Azincourt Energy Corp (the “Optionee”, “Azincourt”) (TSX.V: AAZ, OTC: AZURF), an arms-length party, pursuant to which the Optionee has been granted the option (the “Option”) to acquire up to a seventy-five percent interest in the Hatchet Lake Uranium Project (the “Project”). The Project consists of a series of six mineral claims located in the province of Saskatchewan.

ValOre’s Chairman & CEO Jim Paterson stated: “Azincourt boasts a team of highly experienced and well capitalized Saskatchewan-focused uranium explorers. We are excited to work together with Azincourt to explore the Hatchet Lake Uranium Project and allocate the time and resources that Hatchet Lake merits in this rapidly improving uranium pricing environment.”

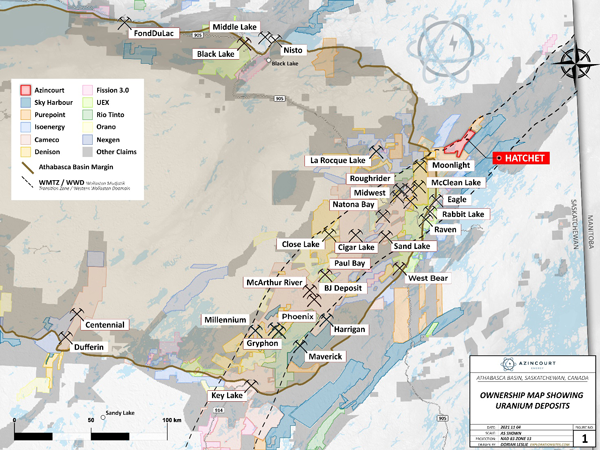

Hatchet Lake is 13,711-hectare uranium exploration project adjacent to the northeastern margin of the Athabasca Basin, situated along the underexplored northeast extension of the Western Wollaston Domain (“WWD”) and Wollaston-Mudjatik Transition Zone (“WMTZ”). This highly-prospective belt hosts the majority of known Canadian uranium deposits and all of Canada’s operating uranium mines (Figures 1 and 2).

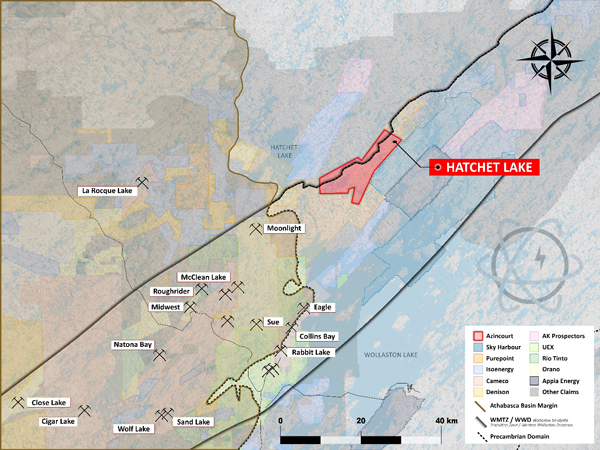

Located 39 kilometres (“km”) along-trend from the Roughrider uranium deposit and within 29 km of Cameco’s Eagle Point uranium mine, Hatchet Lake features multiple, shallow, unconformity-related basement uranium targets based on previous work by both Hathor Exploration Ltd., Rio Tinto, and ValOre (formerly Kivalliq Energy), including geophysics, and boulder, soil, lake sediment and bio-geochemical sampling. The project contains substantial historic exploration datasets with extensive uranium anomalism and showings to help guide exploration programs.

Two high-priority zones on the property have been defined: the Upper Manson and SW Scrimes zones. Previous work includes 140 line-km ground geophysics and a 2007 VTEM survey that identified 30 conductive targets with a combined 53 line-km of strike length. Total samples include 1583 soil, 2404 bio-geochemical, and 24 radioactive rock samples with assay results up to 2.43% U3O8. Geochemical anomalies highlight a variety of uraniferous host rocks that are coincident with conductive geophysical targets.

Terms and Considerations

Pursuant to the terms of the Option, Azincourt can acquire a seventy-five percent interest in the Project by completing a series of cash payments and share issuances to ValOre, and incurring certain expenditures on the Project, as follows:

| Cash Payments | Common Shares | Exploration Expenditures | |

| Upon the grant of the Option | $100,000 | $250,000 | Not Applicable |

| Within 12 Months | $250,000 | $500,000 | $1,000,000 |

| Within 24 Months | $250,000 | $500,000 | $1,000,000 |

| Within 36 Months | $250,000 | $500,000 | $2,000,000 |

All common shares issuable to ValOre will be calculated and issued at a deemed price equivalent to the volume-weighted average closing price of the common shares of Azincourt on the TSX Venture Exchange in the twenty trading days immediately prior to issuance, subject to a minimum price of $0.05.

Following completion of these requirements Azincourt will hold a seventy-five percent interest in the Project. In the event Azincourt does not complete the final cash payment ($250,000) and share issuance ($250,000), and incur the final expenditures ($2,000,000), the Optionee will hold a fifty percent interest in the Project.

All securities issued in connection with the Option will be subject to a four-month-and-one-day statutory hold period. The Option remains subject to the approval of the TSX Venture Exchange. In connection with the grant of the Option, a cash fee of $105,000 is owing by Azincourt to an arms-length party who assisted with the introduction of transaction.

Figure 1: Location of Hatchet Lake project, among uranium deposits, mines and showings, NE Athabasca Basin, Saskatchewan, Canada

Figure 2: Hatchet Lake uranium project, in relation to nearby uranium deposits, mines and showings, NE Athabasca Basin, Saskatchewan, Canada

About Azincourt Energy Corp

Azincourt Energy is a Canadian-based resource exploration and development company focused on the alternative fuels/alternative energy sector. Azincourt’s core projects are in the clean energy space, with uranium exploration projects in the prolific Athabasca Basin, Saskatchewan, Canada, and lithium/uranium projects on the Picotani Plateau, Peru. https://www.azincourtenergy.com/

Qualified Person (QP)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., ValOre’s QP and Vice President of Exploration.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX‐V: VO) is a Canadian company with a portfolio of high‐quality exploration projects. ValOre’s team aims to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration, process improvement, and innovation.

In May 2019, ValOre announced the acquisition of the Pedra Branca Platinum Group Elements (PGE) property, in Brazil, to bolster its existing Angilak uranium, Genesis/Hatchet uranium and Baffin gold projects in Canada.

The Pedra Branca PGE Project comprises 51 exploration licenses covering a total area of 55,984 hectares (138,339 acres) in northeastern Brazil. At Pedra Branca, 5 distinct PGE+Au deposit areas host, in aggregate, a current Inferred Resource of 1,067,000 ounces 2PGE+Au contained in 27.2 million tonnes grading 1.22 g/t 2PGE+Au (CLICK HERE for ValOre’s July 23, 2019 news release). All the currently known Pedra Branca inferred PGE resources are potentially open pittable.

Comprehensive exploration programs have demonstrated the "District Scale" potential of ValOre’s Angilak Property in Nunavut Territory, Canada that hosts the Lac 50 Trend having a current Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds U3O8. For disclosure related to the inferred resource for the Lac 50 Trend uranium deposits, please CLICK HERE for ValOre's news release dated March 1, 2013.

ValOre’s team has forged strong relationships with sophisticated resource sector investors and partner Nunavut Tunngavik Inc. (NTI) on both the Angilak and Baffin Gold Properties. ValOre was the first company to sign a comprehensive agreement to explore for uranium on Inuit Owned Lands in Nunavut Territory and is committed to building shareholder value while adhering to high levels of environmental and safety standards and proactive local community engagement.

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about ValOre Metals Corp., or this news release, please visit our website at www.valoremetals.com or contact Investor Relations at 604.653.9464, or by email at contact@valoremetals.com.

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: http://www.discoverygroup.ca/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of ValOre and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.