Great Bear Reports Successful LP Fault Extension and Infill Drilling: 10.50 g/t Gold Over 13.10 m, 16.50 g/t Gold Over 6.25 m, and 11.18 g/t Gold Over 6.75 m

April 22, 2021 – Vancouver, British Columbia, Canada – Great Bear Resources Ltd. (the "Company" or "Great Bear", TSX-V: GBR; OTCQX: GTBAF) today reported results from its ongoing fully funded $45 million 2021 exploration program at its 100% owned flagship Dixie Project in the Red Lake district of Ontario.

Chris Taylor, President and CEO of Great Bear said, “Predictability is a trait that builds first-class mineral deposits, distinguishing the ‘best of the best’. With every week that goes by, we successfully expand and fill in the LP Fault zone precisely because of its impressive, predictable continuity. In four months so far in 2021, we’ve already extended the area of drill-defined continuous gold mineralization at the LP Fault by approximately 25%. At the scale of the LP Fault, this is an impressive achievement with few current exploration stage parallels.”

With the 13 drill holes included in this release, Great Bear has released 283 LP Fault drill holes and anticipates at least 117 additional LP Fault drill holes will be completed by the end of 2021, for a total of at least 400 drill holes.

Highlights of Current Results

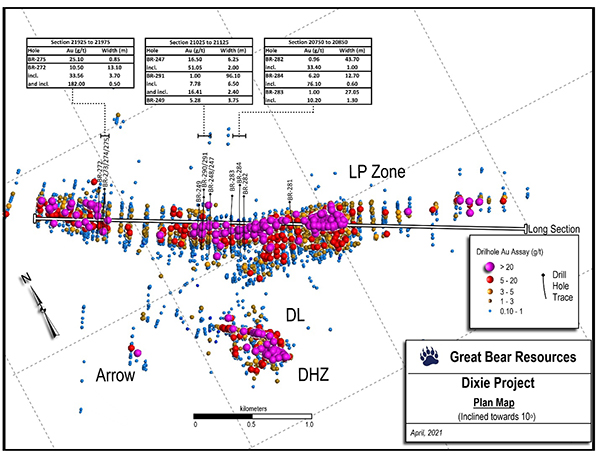

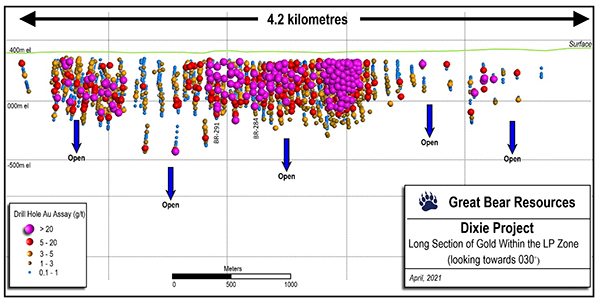

- Drill holes reported in this release intersected the LP Fault zone from approximately 25 to 500 metres vertical depth along 1.7 kilometres of strike length. Figure 1 and Figure 2.

- Drill holes were located a) below previous drilling, and b) within 75 to 100 metre previously undrilled gaps in the zone. Table 1.

- Two drill holes are step-downs that extend gold mineralization by more than 100 metres below previous drilling on two drill sections, expanding the LP Fault zone to depth in these locations.

- BR-284, a 125 metre step-down, assayed 11.18 g/t gold over 6.75 metres from 524.20 to 530.95 metres downhole, and

- BR-291, a 139 metre step-down, assayed 1.00 g/t gold over 96.10 metres from 477.00 to 573.10 metres downhole. This included a high-grade core of 16.41 g/t gold over 2.40 metres from 485.00 to 487.40 metres downhole.

- Infill drilling within 75 – 100 metre previously undrilled gaps in the zone also continues to deliver high-grade and bulk-tonnage gold intercepts.

- BR-272 assayed 10.50 g/t gold over 13.10 metres from 313.20 to 326.30 metres downhole. A high-grade core assaying 33.35 g/t gold over 3.70 metres was present from 313.20 to 316.90 metres downhole.

- BR-247 assayed 16.50 g/t gold over 6.25 metres from 365.00 to 371.25 metres downhole. This included a high-grade core of 169.00 g/t gold over 0.50 metres from 369.50 to 370.00 metres downhole.

Results continue to demonstrate excellent continuity of high-grade and bulk-tonnage gold mineralization. The LP Fault zone remains open to extension in all directions.

Table 1: Current drill results from the LP Fault. Results are arranged by drill section from southeast (top) to northwest (bottom).

| Drill Hole | From (m) | To (m) | Width* (m) | Gold (g/t) | Section | |

| BR-281 | 170.25 | 174.00 | 3.75 | 1.04 | 20300 | |

| and | 254.00 | 255.00 | 1.00 | 4.51 | ||

| BR-282 | 396.50 | 440.20 | 43.70 | 0.96 | 20750 | |

| including | 396.50 | 397.50 | 1.00 | 33.40 | ||

| and | 453.80 | 456.60 | 2.80 | 0.99 | ||

| BR-284 | 518.25 | 530.95 | 12.70 | 6.20 | 20775 | |

| including | 524.20 | 530.95 | 6.75 | 11.18 | ||

| and including | 527.10 | 527.70 | 0.60 | 76.10 | ||

| BR-283 | 400.50 | 423.55 | 23.05 | 1.05 | 20850 | |

| including | 402.40 | 410.50 | 8.10 | 2.59 | ||

| and | 441.00 | 468.05 | 27.05 | 1.00 | ||

| including | 464.90 | 466.20 | 1.30 | 10.20 | ||

| BR-247 | 365.00 | 371.25 | 6.25 | 16.50 | 21025 | |

| including | 368.00 | 370.00 | 2.00 | 51.05 | ||

| and including | 369.50 | 370.00 | 0.50 | 169.00 | ||

| and | 446.65 | 447.15 | 0.50 | 16.90 | ||

| BR-248 | 30.25 | 31.00 | 0.75 | 21.50 | 21025 | |

| and | 295.00 | 296.50 | 1.50 | 1.81 | ||

| and | 418.85 | 419.60 | 0.75 | 1.25 | ||

| BR-290 | 402.10 | 423.00 | 20.90 | 1.07 | 21050 | |

| including | 411.00 | 417.25 | 6.25 | 2.89 |

Table 1 continued.

| Drill Hole | From (m) | To (m) | Width* (m) | Gold (g/t) | Section | |

| BR-291 | 322.90 | 326.90 | 4.00 | 1.12 | 21075 | |

| and | 477.00 | 573.10 | 96.10 | 1.00 | ||

| including | 482.00 | 488.50 | 6.50 | 7.78 | ||

| and including | 485.00 | 487.40 | 2.40 | 16.41 | ||

| and including | 522.00 | 522.50 | 0.50 | 20.40 | ||

| and | 579.70 | 584.30 | 4.60 | 1.42 | ||

| including | 583.70 | 584.30 | 0.60 | 9.38 | ||

| BR-249 | 327.35 | 338.10 | 10.75 | 2.39 | 21125 | |

| including | 334.35 | 338.10 | 3.75 | 5.28 | ||

| BR-273 | 183.00 | 186.00 | 3.00 | 1.09 | 21925 | |

| and | 413.00 | 417.10 | 4.10 | 3.69 | ||

| BR-275 | 420.75 | 426.30 | 5.55 | 2.12 | 21925 | |

| and | 479.00 | 490.05 | 11.05 | 1.24 | ||

| including | 487.35 | 488.10 | 0.75 | 6.02 | ||

| and | 546.70 | 547.55 | 0.85 | 25.10 | ||

| BR-274 | 356.80 | 359.00 | 2.20 | 1.65 | 21950 | |

| including | 394.65 | 396.95 | 2.30 | 3.01 | ||

| BR-272 | 313.20 | 326.30 | 13.10 | 10.50 | 21975 | |

| including | 313.20 | 316.90 | 3.70 | 33.56 | ||

| and including | 313.20 | 313.70 | 0.50 | 182.00 |

* Widths are drill indicated core length, as insufficient drilling has been undertaken to determine true widths at this time. Average grades are calculated with un-capped gold assays, as insufficient drilling has been completed to determine capping levels for higher grade gold intercepts. Interval widths are calculated using a 0.10 g/t gold cut-off grade with up to 3 m of internal dilution of zero grade.

Great Bear’s progress can be followed using the Company’s plan maps, long sections and cross sections, and through the VRIFY model posted at the Company’s web site at www.greatbearresources.ca. All LP Fault drill hole highlighted assays, plus drill collar locations and orientations can also be downloaded at the Company’s web site.

Figure 1: Plan map showing the locations of drill holes reported in this release.

Figure 2: Long section of the LP Fault. Step-down drill holes referenced in this release are labeled.

Drill collar location, azimuth and dip for drill holes included in this release are provided in the table below (UTM zone 15N, NAD 83):

| Hole ID | Easting | Northing | Elevation | Length | Dip | Azimuth |

| BR-247 | 456733 | 5634598 | 359 | 693 | -62 | 218 |

| BR-248 | 456677 | 5634536 | 363 | 552 | -60 | 217 |

| BR-249 | 456600 | 5634560 | 360 | 522 | -61 | 217 |

| BR-272 | 455943 | 5635108 | 374 | 549 | -56 | 216 |

| BR-273 | 455981 | 5635073 | 375 | 573 | -56 | 223 |

| BR-274 | 455981 | 5635073 | 373 | 539 | -60 | 223 |

| BR-275 | 455981 | 5635073 | 375 | 615 | -67 | 223 |

| BR-281 | 457274 | 5634206 | 354 | 399 | -46 | 200 |

| BR-282 | 456962 | 5634438 | 356 | 648 | -59 | 208 |

| BR-283 | 456887 | 5634501 | 357 | 657 | -56 | 210 |

| BR-284 | 456976 | 5634533 | 358 | 681 | -55 | 216 |

| BR-290 | 456668 | 5634603 | 359 | 459 | -59 | 216 |

| BR-291 | 456700 | 5634655 | 359 | 702 | -59 | 217 |

About the Dixie Project

The Dixie Project is 100% owned, comprised of 9,140 hectares of contiguous claims that extend over 22 kilometres, and is located approximately 25 kilometres southeast of the town of Red Lake, Ontario. The project is accessible year-round via a 15 minute drive on a paved highway which runs the length of the northern claim boundary and a network of well-maintained logging roads.

The Dixie Project hosts two principal styles of gold mineralization:

- High-grade gold in quartz veins and silica-sulphide replacement zones (Dixie Limb, Hinge and Arrow zones). Hosted by mafic volcanic rocks and localized near regional-scale D2 fold axes. These mineralization styles are also typical of the significant mined deposits of the Red Lake district.

- High-grade disseminated gold with broad moderate to lower grade envelopes (LP Fault). The LP Fault is a significant gold-hosting structure which has been seismically imaged to extend to 14 kilometres depth (Zeng and Calvert, 2006), and has been interpreted by Great Bear to have up to 18 kilometres of strike length on the Dixie property. High-grade gold mineralization is controlled by structural and geological contacts, and moderate to lower-grade disseminated gold surrounds and flanks the high-grade intervals. The dominant gold-hosting stratigraphy consists of felsic sediments and volcanic units.

About Great Bear

Great Bear Resources Ltd. is a well-financed gold exploration company managed by a team with a track record of success in mineral exploration. Great Bear is focused in the prolific Red Lake gold district in northwest Ontario, where the company controls over 330 km2 of highly prospective tenure across 5 projects: the flagship Dixie Project (100% owned), the Pakwash Property (earning a 100% interest), the Dedee Property (earning a 100% interest), the Sobel Property (earning a 100% interest), and the Red Lake North Property (earning a 100% interest) all of which are accessible year-round through existing roads.

QA/QC and Core Sampling Protocols

Drill core is logged and sampled in a secure core storage facility located in Red Lake Ontario. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to Activation Laboratories in Ontario, an accredited mineral analysis laboratory, for analysis. All samples are analysed for gold using standard Fire Assay-AA techniques. Samples returning over 10.0 g/t gold are analysed utilizing standard Fire Assay-Gravimetric methods. Pulps from approximately 5% of the gold mineralized samples are submitted for check analysis to a second lab. Selected samples are also chosen for duplicate assay from the coarse reject of the original sample. Selected samples with visible gold are also analyzed with a standard 1 kg metallic screen fire assay. Certified gold reference standards, blanks and field duplicates are routinely inserted into the sample stream, as part of Great Bear’s quality control/quality assurance program (QAQC). No QAQC issues were noted with the results reported herein.

Qualified Person and NI 43-101 Disclosure

Mr. R. Bob Singh, P.Geo, VP Exploration, and Ms. Andrea Diakow P.Geo, Exploration Manager for Great Bear are the Qualified Persons as defined by National Instrument 43-101 responsible for the accuracy of technical information contained in this news release.

ON BEHALF OF THE BOARD

“Chris Taylor”

Chris Taylor, President and CEO

Investor Inquiries:

Mr. Knox Henderson

Tel: 604-646-8354

Direct: 604-551-2360

info@greatbearresources.ca

www.greatbearresources.ca

Cautionary note regarding forward-looking statements

This release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes.

Forward-looking information are based on management of the parties’ reasonable assumptions, estimates, expectations, analyses and opinions, which are based on such management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect.

Such factors, among other things, include: impacts arising from the global disruption caused by the Covid-19 coronavirus outbreak, business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold or certain other commodities; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); discrepancies between actual and estimated metallurgical recoveries; inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties.

Great Bear undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management's best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.