Kodiak Expands MPD Project Through Acquisition of Axe Copper-Gold Property

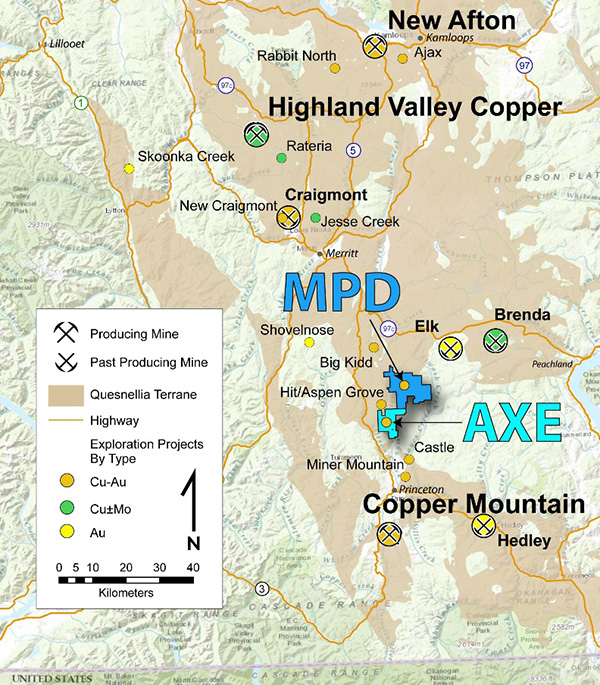

April 19, 2021 – Vancouver, British Columbia – Kodiak Copper Corp. (the "Company" or “Kodiak”) (TSX-V: KDK) is pleased to announce that it has entered into a purchase agreement to acquire a 100% interest in the Axe Copper-Gold Property (“Axe”) from Orogen Royalties (“Orogen”, TSXV:OGN). Axe is contiguous with Kodiak’s 100% owned MPD Project (“MPD”) in Southern British Columbia in the prolific Quesnel Trough (see Figure 1), with year-round accessibility from paved roads and excellent infrastructure. Axe is host to a porphyry complex comprised of four drill-proven copper-gold porphyry centres and has potential for additional targets similar to Kodiak’s Gate Zone.

Axe Property Highlights

- 4,980 hectare property located 20 kilometers north of the town of Princeton, immediately south of, and contiguous with Kodiak’s MPD Property.

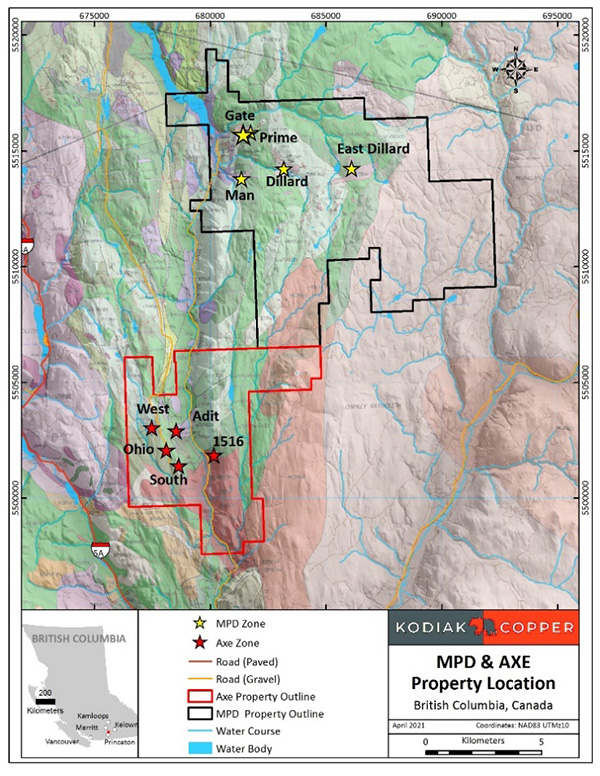

- The Axe acquisition expands Kodiak’s land holdings to 14,716 hectares (147 square kilometres) to become a large-scale exploration opportunity with multiple proven copper-gold occurrences with exploration upside.

- The Axe property hosts similar geology as the MPD Property (see Figure 2) and is situated within Nicola Volcanic Belt rocks that are also associated with the Highland Valley, Copper Mountain and New Afton Mines.

- Four known zones of porphyry copper-gold mineralization (West, Adit, Mid, and South) occur within an extensive copper-gold porphyry system having a 17 square kilometre hydrothermal footprint.

- 264 holes (24,577 metres) of historic drilling date back to the 1960’s. The vast majority are shallow percussion/reverse circulation holes with only 12 diamond drill holes exceeding 300 metres depth.

- Historic drill results from the “West Zone” target include:

- 124 metres of 0.38% copper and 0.22 grams per tonne ("g/t") gold including 10.5 metres of 1.55% copper and 0.94 g/t gold

- 45 metres of 0.53% copper and 0.15 g/t gold

- 49.5 metres of 0.31% copper and 1.29g/t gold

- 124 metres of 0.38% copper and 0.22 grams per tonne ("g/t") gold including 10.5 metres of 1.55% copper and 0.94 g/t gold

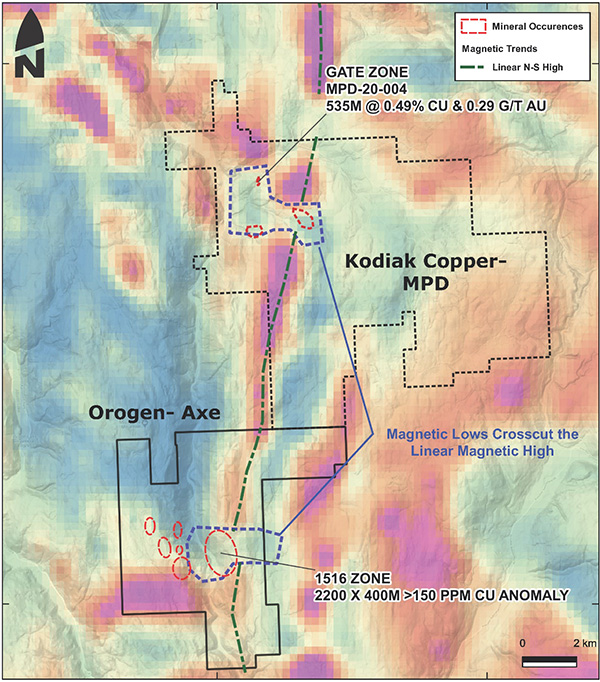

- The “1516 Zone” represents an underexplored, near-term drill target situated in eastern Nicola Group Belt rocks, having similar structural, geochemical, and geophysical properties to the Gate Zone.

- Like Gate, the 1516 Zone is a copper, gold, molybdenum in soil anomaly (2200 metre by 400 metre and open) with a coincident chargeability and conductivity geophysical anomaly It is represented by a magnetic low/break in the north-northeast regional magnetic trend, and appears associated with complex faults or splays off the regional Summers Creek Fault (see Figure 3).

- Quality historic exploration datasets are available for the Axe Property which will quickly and cost-effectively advance exploration and generate new targets.

- The Axe Property is permitted for drilling with a multi-year, area-based Exploration Permit.

Claudia Tornquist, President and CEO of Kodiak said, “The acquisition of the contiguous Axe claims extends our MPD project area and is an excellent strategic fit for Kodiak. Like MPD, the Axe Property hosts several significant, historic copper-gold porphyry centres and has potential for large-scale copper-gold porphyry mineralization. Historic work has focused on the west side of the property, with most discoveries made by near surface drilling less than 300 metres deep. Kodiak believes there is considerable exploration upside at depth, and in underexplored areas on the property, particularly the 1516 Zone. We look forward to unlocking this excellent potential with a view to potentially making another transformative discovery.”

Chris Taylor, Chairman of Kodiak said, “The unprecedented positive market conditions for copper make Kodiak’s control of an easily accessed copper gold region within the prolific Quesnel Belt a compelling opportunity for our shareholders. Previous drilling on the property could have missed “Gate Zone-style” high-grade copper-gold targets that may also exist at Axe. Kodiak will now apply the same systematic exploration approach that led to the discovery of the Gate Zone at MPD.”

Transaction Details

Kodiak has entered into a property purchase agreement to acquire a 100% interest in the Axe Property, subject to the approval of the TSX-Venture Exchange and other customary conditions. The consideration for Axe consists of:

- 950,000 in Kodiak shares upon closing of the transaction;

- A 2% net smelter returns royalty on the Axe property of which 0.5% may be purchased by Kodiak for C$2,000,000 at any time;

- A cash payment equivalent to the value of 75,000 Orogen shares up to a maximum of C$50,000 upon the completion of 5,000 metres of drilling on the Axe Property;

- A cash payment equivalent to the value of 200,000 Orogen shares up to a maximum of C$150,000 upon the announcement of a measured or indicated mineral resource estimate of at least 500,000,000 tonnes at a grade of at least 0.40% copper equivalent; and

- A cash payment equivalent to the value of 250,000 Orogen shares up to a maximum of C$200,000 upon the completion of a feasibility study on the Axe Property.

Figure 1: Location Map, MPD-Axe Properties

Source: BC Geological Survey

Figure 2: Geology and Copper Porphyry Zones, MPD-Axe Properties

Source: Geology, M. Mihalynuk, L Diakow, 2020

Figure 3: Setting of 1516 and Gate Zones, Total Magnetic Intensity

Source: Orogen Royalties

Jeff Ward, P.Geo, Vice President Exploration and the Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information contained in this release.Kodiak believes historic results referenced here to be from reliable sources using industry standards at the time.However, the Company has not performed any exploration at Axe to date and cannot guarantee the accuracy ofhistoric information contained herein.

For further information please contact Mr. Knox Henderson, Investor Relations, at 604-551-2360 or khenderson@kodiakcoppercorp.com.

On behalf of the Board of Directors

Kodiak Copper Corp.

Claudia Tornquist

President & CEO

About Kodiak Copper Corp.

Kodiak is focused on its 100% owned copper porphyry projects in Canada and the USA. The Company’s most advanced asset is the MPD copper-gold porphyry project in the prolific Quesnel Trough in south-central British Columbia, Canada, where the Company made a discovery of high-grade mineralization within a wide mineralized envelope in 2020. Kodiak also holds the Mohave copper-molybdenum-silver porphyry project in Arizona, USA, near the world-class Bagdad mine. Kodiak’s porphyry projects have both been historically drilled and present known mineral discoveries with the potential to hold large-scale deposits.

Kodiak’s founder and Chairman is Chris Taylor who is well-known for his gold discovery success with Great Bear Resources. Kodiak is also part of Discovery Group led by John Robins, one of the most successful mining entrepreneurs in Canada.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement (Safe Harbor Statement): This press release contains forward looking statements within the meaning of applicable securities laws. The use of any of the words “anticipate”, “plan”, “continue”, “expect”, “estimate”, “objective”, “may”, “will”, “project”, “should”, “predict”, “potential” and similar expressions are intended to identify forward looking statements. In particular, this press release contains forward looking statements concerning the Company’s exploration plans. Although the Company believes that the expectations and assumptions on which the forward looking statements are based are reasonable, undue reliance should not be placed on the forward looking statements because the Company cannot give any assurance that they will prove correct. Since forward looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with conditions in the equity financing markets, and assumptions and risks regarding receipt of regulatory and shareholder approvals.

Management has provided the above summary of risks and assumptions related to forward looking statements in this press release in order to provide readers with a more comprehensive perspective on the Company’s future operations. The Company’s actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward looking statements are made as of the date of this press release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward looking statements, whether as a result of new information, future events or results or otherwise.