ValOre Reports Encouraging Ore Sorting Potential for Pedra Branca PGE Project; 176.52 g/t 2PGE+Au in Historical Core Re-Assay

Vancouver, B.C. ValOre Metals Corp. (“ValOre”; TSX-V: VO; OTC: KVLQF; Frankfurt: KEQ0, “the Company”) today announced encouraging STEINERT ore sorting testwork results for ValOre’s 100%-owned Pedra Branca Platinum Group Element (“PGE”) Project in northeastern Brazil. Results from the ore sorting program, which used a set of 100 re-assayed and catalogued 5-cm samples of historical NQ drill core from the Esbarro PGE deposit, demonstrated distinct density responses for mineralized rock types, as well as barren granites and gneisses.

Sensory-based rock sorting technologies such as STEINERT can concentrate ores, remove waste rock and cut process costs to generate significant positive economic implications for both metallurgy and OPEX.

“STEINERT ore sorting testwork was initiated to assess the sortability of mineralized and non-mineralized rock types at Pedra Branca, with the ultimate goal of improving metallurgical performance and processing economics. As part of this test work, the sample set taken from historic NQ drill core was re-assayed and returned the highest-grade value from a drill core sample in the history of the project, clearly demonstrating the presence of high-grade, near-surface PGEs at Pedra Branca,” stated ValOre’s Chairman and CEO, Jim Paterson. “These results are very encouraging and warrant immediate expansion of this testwork. ValOre geologists are preparing a bulk sample to support a comprehensive, quantitative follow-up sorting test program.”

Highlights from Ore Sorting Testwork at Esbarro Deposit:

- Sensor-based ore sorting testwork by STEINERT GmbH demonstrated excellent rock density sortability, evidenced by distinct X-Ray Transmission (“XRT”) responses for both PGE mineralized and barren Pedra Branca rock types;

- Chromitite samples returned the most distinct XRT response, demonstrating the greatest potential for ore sorting technology to facilitate a high-grade fraction;

- Barren granite and gneiss samples exhibited a unique XRT response, indicating the potential to separate waste rock from PGE-mineralized rock allowing for less process dilution;

- PGE-mineralized dunite, peridotite and serpentinite samples displayed strong XRT response groupings, revealing further potential for sensor-based ore sorting;

- Re-assaying of historical drill core for STEINERT from the Esbarro PGE deposit returned the highest-grade drill core sample in the history of the project from a 5-centimetre (“cm”) sample of NQ drill core at 30.35 metres (“m”) depth in drill hole DD18ES15A:

- 176.52 grams per tonne (“g/t”) palladium + platinum + gold (“2PGE+Au”)

- Comprising 133.35 g/t Pd, 42.24 g/t Pt, and 0.93 g/t Au

- Also returned 3.30 g/t rhodium (“Rh”), or 179.82 g/t 3PGE+Au;

- PGE grades for the major lithologies selected for ore sorting testwork include:

- Chromitites (“Cr”, “Cr-reef”): 0.17-30.44 g/t 2PGE+Au (average 10.33 g/t, excluding sample from DD18ES15A grading 176.52 g/t 2PGE+Au)

- Dunites/peridotites/serpentinites/pyroxenites: 0.07-10.15 g/t 2PGE+Au (average 1.86 g/t)

- Granites/gneisses/amphibolites: barren;

- Based on the encouraging initial sortability test results, ValOre will broaden the scope for more thorough quantitative assessment with a 300 kilogram (“kg”) bulk sample to support additional testwork at STEINERT.

Esbarro PGE Deposit Ore Sorting Testwork

The Esbarro PGE deposit hosts an at-surface resource estimate of 9.9 million tonnes (“Mt”) grading 1.23 g/t 2PGE+Au totaling 394,000 ounces (“oz”). CLICK HERE for the Pedra Branca NI 43-101 Technical Report. The resource estimate is supported by 91 drill holes, with an average hole spacing of 45 m and is situated within a 3-kilometre (“km”) radius of additional at-surface PGE resource areas, Cedro (4.2 Mt grading 1.10 g/t 2PGE+Au totaling 151,000 oz) and Curiu (1.6 Mt grading 1.93 g/t 2PGE+Au totaling 100,000 oz). CLICK HERE for Figure 1A and 1B, showing the location of the five Pedra Branca PGE resource areas and a detailed view of Esbarro, respectively.

STEINERT ore sorting testwork was initiated to assess the sortability of PGE mineralized rocks from barren rocks at Pedra Branca, with the ultimate goal of improving metallurgical performance and processing economics. One hundred historical drill core samples from six representative rock types were submitted from the Esbarro deposit, and sensory-based results were compared with assay data from SGS, Vespasiano, Minas Gerais to assess both rock type- and grade-dependent sortability. CLICK HERE for Table 1, showing the full list of samples, assay results, and sensor results.

Density data from STEINERT XRT analyses demonstrated distinct sensory responses for mineralized rock types (chromitites, dunites, peridotites) and barren lithologies (granites and gneisses). The distinct XRT-assessed densities reported herein demonstrate excellent potential sortability of:

- high-grade PGE rocks types (chromitite);

- low- to medium-grade PGE rock types (dunites, peridotites, serpentinites, pyroxenites); and

- barren waste rock types (granites and gneisses).

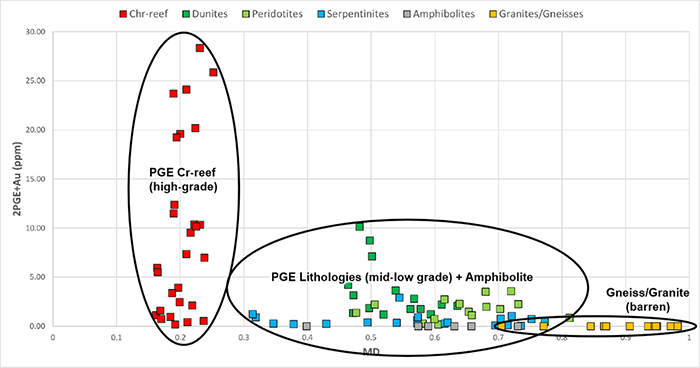

XRT density data is recorded as Minimum Density (“MD”), which reports the proportion of XRT-defined pixels inside the low-density curve, with lower MD values representing higher rock density. See Figure 2 Table 2 below for a graph of 2PGE+Au (g/t) versus MD, and a summary table of average MD values for each rock type, respectively.

Figure 2: Graph of 2PGE+Au (g/t) versus MD, Demonstrating Excellent Sortability

Table 2: Summary of MD Values, Demonstrating Excellent Sortability

| Rock Type | # Samples | Relative Grade | Average MD |

| Chromitite | 30 | High (avg. 10 g/t) | 0.20 |

| Dunite | 15 | Medium (avg. 3.5 g/t) | 0.53 |

| Peridotite | 15 | Medium (avg. 1.8 g/t) | 0.64 |

| Serpentinite/Pyroxenite | 9 | Low (avg. 0.4 g/t) | 0.60 |

| Serpentinite/Dunite | 11 | Low (avg. 0.8 g/t) | 0.55 |

| Gneiss/Granite/Amphibolite | 20 | Barren | 0.78 |

Note: MD (Minimum Density) represents XRT proportion of pixels inside the low-density curve, per particle. Lower MD = higher density.

Assaying of the 100 core samples used for STEINERT testwork returned the highest-grade drill core sample in the history of the Pedra Branca project: 176.52 g/t 2PGE+Au (133.35 g/t Pd, 42.24 g/t Pt and 0.93 g/t Au), in addition to 3.30 g/t Rh (179.82 g/t 3PGE+Au). This sample was collected from a 5-cm sample of NQ drill core at 30.35 m depth in drill hole DD18ES15A. This clearly demonstrates the presence of high-grade, near-surface PGEs at Pedra Branca. See Table 3 below for the 3PGE+Au assay results.

Table 3: Assay Results for Core Sample 99035

| Drill Hole | Sample | Depth (m) |

Au (g/t) |

Pd (g/t) |

Pt (g/t) |

2PGE+Au (g/t) |

Rh (g/t) |

3PGE+Au (g/t) |

| DD18ES15A | 99035 | 30.4 | 0.93 | 133.35 | 42.24 | 176.52 | 3.30 | 179.82 |

About STEINERT Ore Sorting

STEINERT GmbH supplies sensory-based rock sorting technologies to operating mining projects around the world. Sorting waste rock from ore at an early processing stage has significant positive economic implications for reducing both metallurgy and operating costs.

XRT is ideally suited for ore sorting because the x-ray radiation can penetrate stones with particle sizes up to 100 mm. In addition to XRT, STERINERT offers further sensors that can be combined with one another in a multi-faceted sensory approach. X-Ray Fluorescence (“XRF”) can be used to determine and sort individual chemical elements very precisely. Further, optical sorting and lasers are very well suited to the detection of ores with different colours, such as copper oxide, or crystalline structures in quartz.

Further information about STEINERT ore sorting can be found in the link below:

https://steinertglobal.com/

Qualified Person (QP)

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., ValOre’s QP, who oversees New Project Review for ValOre.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX-V: VO) is a Canadian company with a portfolio of high-quality exploration projects. ValOre’s team aims to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration, process improvement, and innovation.

In May 2019, ValOre announced the acquisition of the Pedra Branca Platinum Group Elements (PGE) property, in Brazil, to bolster its existing Angilak uranium, Genesis/Hatchet uranium and Baffin gold projects in Canada.

The Pedra Branca PGE Project comprises 38 exploration licenses covering a total area of 38,940 hectares (96,223 acres) in northeastern Brazil. At Pedra Branca, 5 distinct PGE+Au deposit areas host, in aggregate, a current Inferred Resource of 1,067,000 ounces 2PGE+Au contained in 27.2 million tonnes grading 1.22 g/t 2PGE+Au (see ValOre’s July 23, 2019 news release). All the currently known Pedra Branca inferred PGE resources are potentially open pittable.

Comprehensive exploration programs have demonstrated the "District Scale" potential of ValOre’s Angilak Property in Nunavut Territory, Canada that hosts the Lac 50 Trend having a current Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds U3O8. For disclosure related to the inferred resource for the Lac 50 Trend uranium deposits, please refer to ValOre's news release of March 1, 2013.

ValOre’s team has forged strong relationships with sophisticated resource sector investors and partner Nunavut Tunngavik Inc. (NTI) on both the Angilak and Baffin Gold Properties. ValOre was the first company to sign a comprehensive agreement to explore for uranium on Inuit Owned Lands in Nunavut Territory and is committed to building shareholder value while adhering to high levels of environmental and safety standards and proactive local community engagement.

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about, ValOre Metals Corp. or this news release, please visit our website at www.valoremetals.com or contact Investor Relations toll free at 1.888.331.2269, at 604.653.9464, or by email at contact@valoremetals.com.

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: discoverygroup.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of ValOre and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.