ValOre Outlines 2020 Exploration Program for Pedra Branca; Secures $1.2 Million Financing

Vancouver, B.C. ValOre Metals Corp. ("ValOre" or the “Company”; TSX-V: VO) today announced board approval for the proposed 2020 core drilling exploration program at ValOre’s 100%-owned Pedra Branca Platinum Group Element Project (“PGE”, “2PGE+Au”) in northeastern Brazil. ValOre also announced that it has entered into a C$1.2 million unsecured revolving credit facility to fully fund the first phase of the proposed drill program at Pedra Branca.

“We are excited to begin drilling Pedra Branca and to really showcase the compelling potential of our PGE project,” stated Jim Paterson, Chairman & CEO. “We have identified many new high-priority targets in our two-phase program, which is designed to expand the current resource, advance existing targets and test undrilled areas. With $1.2 million in funding now committed, we can ramp up exploration activities at Pedra Branca and begin the process of safely mobilizing drill rigs and personnel to Pedra Branca.”

Pedra Branca 2020 Drill Program

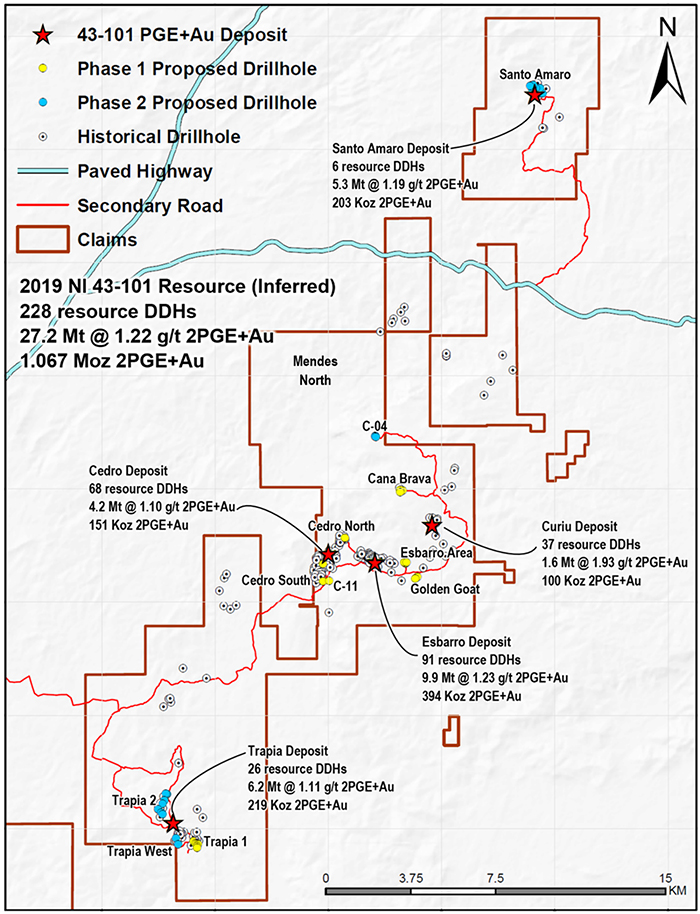

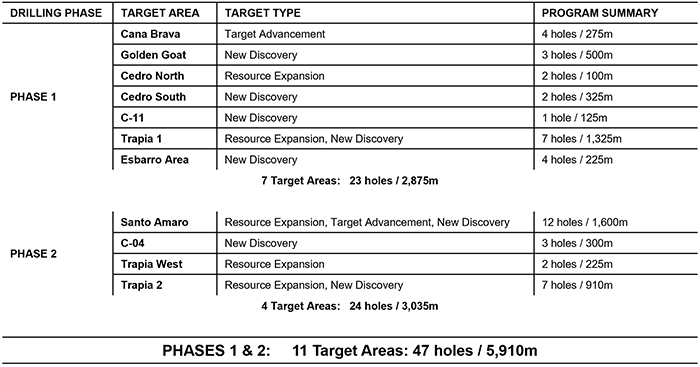

The proposed fully-permitted drill program is comprised of two phases, with 2,875 metres in (“Phase 1”) and 3,035 metres in (“Phase 2”), and a scheduled start of Phase 1 in June. Details of each phase, including targets, total meters and number of drill holes are summarized in Figure 1 and Table 1 below.

Highlights of the Proposed 2020 Pedra Branca PGE Drill Program:

- Comprised of two successive, fully permitted phases, totaling approximately 2,875 m and 3,035 m, respectively, for a total of 5,910 m;

- Focused on three target classes:

- Resource Expansion;

- New Discovery (undrilled targets); and

- Target Advancement (following-up historical drill intercepts at pre-resource targets)

- Phase 1 (fully funded) is planned to test 7 distinct target areas with 23 total core drill holes, and Phase 2 is planned to test 4 distinct target areas with 24 total drill holes, with an average hole length of 125m for both phases, reflecting the shallow nature of Pedra Branca PGE mineralization;

- All access and drill hole locations have been visited by a registered Brazilian environmental consultancy (SSA Consultoria) and classified as “without need for vegetation suppression” by re-activating existing access routes, utilizing pre-existing drill pad sites and the presence of extensive agricultural development in the region;

- Access to, and approval for drill water supply from local reservoirs has been secured;

- ValOre continues to receive full support from the local community of Capitão Mor, as well as Ceará State and federal governmental agency, ANM (Agência Nacional de Mineração) for on-going exploration of the Pedra Branca PGE Project.

Figure 1: Location of Proposed Phase 1 and Phase 2 Drill Targets; Mendes North

Table 1: Summary Table of Phase 1 and Phase 2 Drill Programs

Mendes North Update

Soil sampling at the three Mendes North PGE targets (“Mendes North”) is on-going and near-completion, with Targets 1 and 2 sampled in full, and Target 3 to be completed by the end of next week. As announced in ValOre’s March 30, 2020 press release, these three >1km PGE targets were identified using WorldView True-Colour imagery, WorldView spectral data and re-processed ground magnetic geophysical data. Further, ValOre generated a 3D magnetic inversion model of the Mendes North target area which delineated the WorldView-mag anomalies as compelling near surface targets. Approximately 600 samples will be collected (with a total of 453 collected to date) and consigned to SGS Geosol Laboratórios Ltda. (“SGS Geosol” an accredited mineral analysis laboratory) in Vespasiano, Minas Gerais for assay.

Soil samples were collected from field sites spaced 20 metres apart on lines spaced 100 metres apart, with coordinate data captured by handheld GPS. These samples are subsequently stored in a secure ValOre facility in Capitão Mor, Ceará, Brazil and thereafter sent with an ensured chain of custody to SGS Geosol. All samples are analyzed for PGE+Au (Pd, Pt, Au) content using standard 50g Fire Assay and ICP-AES techniques. Certified PGE ore reference standards, blanks and field duplicates are inserted as a part of ValOre’s Quality Control/Quality Assurance program (“QA/QC”).

Financing

To finance its corporate and exploration activities for the coming year, ValOre has entered into an unsecured revolving credit facility with Jim Paterson, the Company’s Chairman and CEO, pursuant to which the Company may borrow up to $1.2 million on a revolving basis. ValOre will pay to Mr. Paterson a standby fee of $24,000 (2% of the committed facility) and interest of 10% per annum on amounts drawn down under the facility. ValOre has agreed to use commercially reasonable efforts to complete an equity financing prior to December 31, 2020 in an amount sufficient to repay amounts borrowed under the facility.

Qualified Person

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements as set out in NI 43-101 and this news release has been reviewed and approved by Colin Smith, P.Geo., who oversees New Project Review for ValOre.

About ValOre Metals Corp.

ValOre Metals Corp. (TSX-V: VO) is a Canadian company with a portfolio of high-quality exploration projects. ValOre’s team aims to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration, process improvement, and innovation.

In May 2019, ValOre announced the acquisition of the Pedra Branca Platinum Group Elements (PGE) property, in Brazil, to bolster its existing Angilak uranium, Genesis/Hatchet uranium and Baffin gold projects in Canada.

The Pedra Branca PGE Project comprises 38 exploration licenses covering a total area of 38,940 hectares (96,223 acres) in northeastern Brazil. At Pedra Branca, 5 distinct PGE+Au deposit areas host, in aggregate, a NI 43-101 Inferred Resource of 1,067,000 ounces 2PGE+Gold (Palladium, Platinum and Gold; Pd, Pt+Au) contained in 27.2 million tonnes (“Mt”) grading 1.22 grams 2PGE+Gold per tonne (“g 2PGE+Au/t”) (see ValOre’s July 23, 2019 news release). PGE mineralization outcrops at surface and all of the inferred resources are potentially open pittable.

Comprehensive exploration programs have demonstrated the "District Scale" potential of ValOre’s Angilak Property in Nunavut Territory, Canada that hosts the Lac 50 Trend having a NI 43-101 Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds U3O8. ValOre's. For disclosure related to the inferred resource for the Lac 50 Trend uranium deposits, please refer to ValOre's news release of March 1, 2013.

ValOre’s team has forged strong relationships with sophisticated resource sector investors and partner Nunavut Tunngavik Inc. (NTI) on both the Angilak and Baffin Gold Properties. ValOre was the first company to sign a comprehensive agreement to explore for uranium on Inuit Owned Lands in Nunavut Territory and is committed to building shareholder value while adhering to high levels of environmental and safety standards and proactive local community engagement.

On behalf of the Board of Directors,

"Jim Paterson"

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about, ValOre Metals Corp. or this news release, please visit our website at www.valoremetals.com or contact Investor Relations toll free at 1.888.331.2269, at 604.646.4527, or by email at contact@valoremetals.com.

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: www.discoverygroup.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of the Company and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.