Great Bear Drills Major Hinge Zone Expansion to 440 m Down-Plunge: 3.90 m of 18.09 g/t Gold, Including 1.00 m of 69.97 g/t Gold

July 10, 2019 – Vancouver, British Columbia, Canada – Great Bear Resources Ltd. (the "Company" or "Great Bear", TSX-V: GBR) today reported a significant expansion of the Hinge Zone high-grade gold discovery at its 100% owned Dixie Project in the Red Lake District of Ontario.

Chris Taylor, President and CEO of Great Bear said, “Our strong results drove us to fast track our exploration process with aggressive new step-down drilling. We have now hit more high-grade gold mineralization 440 metres down-plunge from surface and 150 metres down-plunge from the nearest previously reported high-grade intercept. Results suggest the Hinge Zone projects from near-surface with significant depth potential, and contains a high degree of continuity of gold mineralization within its extensive vein network. During 2019, we plan to test its continuity down to increasing depths, and will also drill deeper and along strike into what we interpret as at least 6 additional gold zones with similar plunges along the 500 metre strike length of the Hinge Zone vein swarm we have drilled so far.”

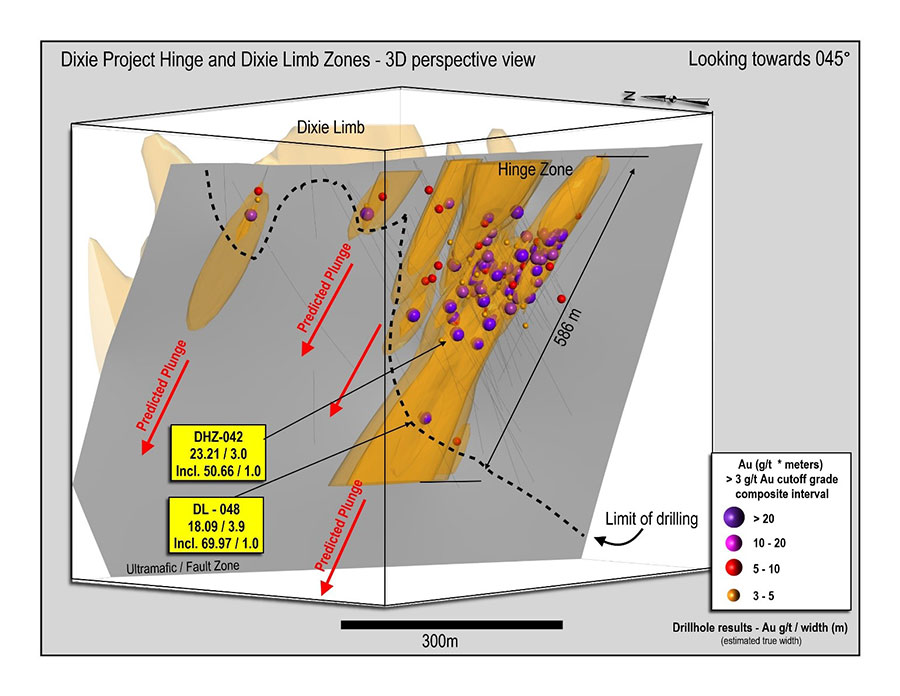

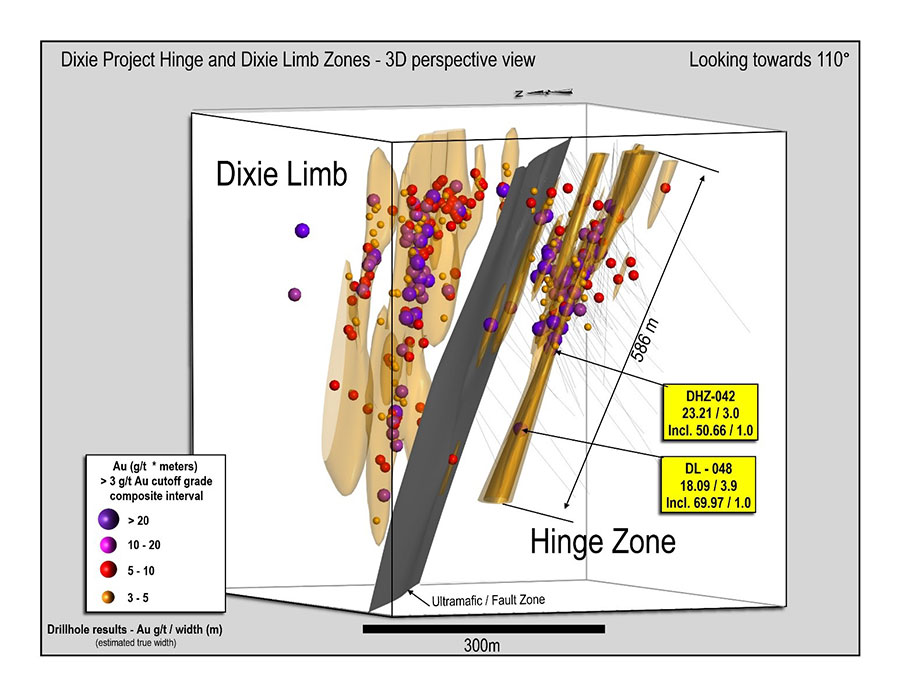

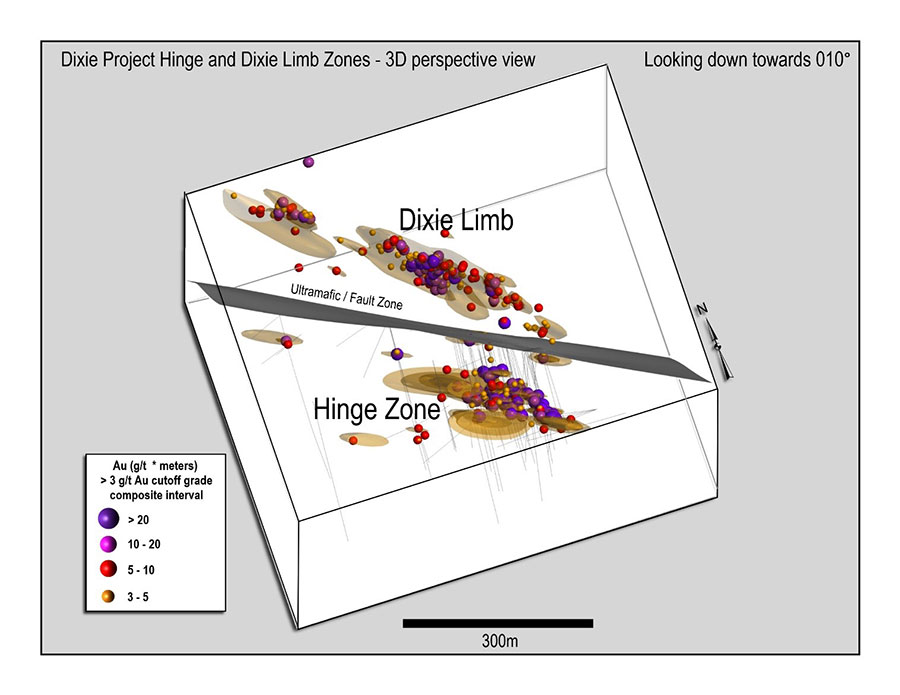

New 3D sections of the Hinge Zone and Dixie Limb, showing multiple steeply-plunging gold zones, are provided in Figure 1, Figure 2 and Figure 3. The most recent assay results are provided in Table 1.

Highlights of the most recent Hinge Zone drill results include:

- All 11 drill holes (100%) intersected from 1 to 5 gold-bearing quartz veins

- Drill hole DHZ-042 intersected 3.00 metres of 23.21 g/t gold including 1.00 metre of 50.66 g/t gold at 229 metres vertical depth

- Drill hole DL-048 intersected 3.90 metres of 18.09 g/t gold including 1.00 metre of 69.97 g/t gold at 342 metres vertical depth, 150 metres down-plunge of previous high-grade intercepts

July 2019 marks the one year anniversary of Great Bear’s Hinge Zone drill program. A summary of some key points of the Hinge Zone discovery as drilled to-date include:

- The Hinge Zone gold-bearing quartz vein swarm has been drilled for over 500 metres of east-west strike length and remains open to extension.

- The D2 Axial plane which is interpreted to be an important control to the vein swarm has a possible east-west strike extent of up to 5 kilometres within the Dixie greenstone belt, before intersecting a granitic batholith to the west.

- Drilling has thus far observed that the vein swarm contains at least 6 steeply-plunging high-grade sub-zones, and the Company is drilling east-west and north-south drill fences in an effort to discover the total number of sub-zones that are present, and delineate their geometries along strike and at depth.

- The Hinge Zone vein swarm has an approximate north-south extent, or total known zone width based on drilling, of 300 m, flanking an ultramafic-hosting fault. Proximity to the fault is interpreted to be a key gold mineralization control at both the Hinge and Dixie Limb Zones.

- The generally predictable plunges of Hinge Zone gold zones observed to-date (approx. 70 degrees to the west) have greatly increased the speed and efficiency of drill progress.

Figure 1: 3D section of the Hinge Zone showing drill results to-date.

With its recently-completed financing, Great Bear currently has approximately $20,000,000 in cash and low operating all-in drill costs of approximately $175/metre. The Company continues to undertake a fully funded, 90,000 metre drill program that is expected to continue through 2019 and 2020. Targets tested will include the Hinge Zone, Dixie Limb Zone, Bear-Rimini Zone, LP Fault, North Fault, and other targets across the property. In order to accelerate the program, a second drill rig was added in February, and a third drill rig arrived in June 2019. Approximately 60,000 metres of drilling remain in the current program.

Table 1: Highlighted results from most recent Hinge Zone drilling.

| Drill Hole | From (m) |

To (m) |

Width* (m) |

Gold (g/t) |

Vein | Vertical Depth (m) |

|

| DHZ-040 | 257.30 | 258.30 | 1.00 | 16.56 | 1 | 206 | |

| including | 257.80 | 258.30 | 0.50 | 31.59 | |||

| and | 264.50 | 265.00 | 0.50 | 8.43 | 2 | 212 | |

| DHZ-041 | 159.50 | 161.00 | 1.50 | 1.95 | 1 | 138 | |

| including | 160.00 | 160.50 | 0.50 | 3.70 | |||

| and | 166.30 | 167.30 | 1.00 | 2.57 | 2 | 143 | |

| including | 166.80 | 167.30 | 0.50 | 4.55 | |||

| and | 183.00 | 183.50 | 0.50 | 3.38 | 3 | 157 | |

| DHZ-042 | 276.90 | 279.90 | 3.00 | 23.21 | 1 | 229 | |

| including | 276.90 | 278.90 | 2.00 | 34.12 | |||

| and including | 276.90 | 277.90 | 1.00 | 50.66 | |||

| DHZ-043 | 108.50 | 110.00 | 1.50 | 2.69 | 1 | 99 | |

| including | 109.00 | 109.50 | 0.50 | 5.07 | |||

| and | 184.50 | 185.00 | 0.50 | 4.37 | 2 | 167 | |

| DHZ-044 | 218.15 | 225.05 | 6.90 | 4.56 | 1 | 181 | |

| including | 218.15 | 222.55 | 4.40 | 6.39 | |||

| and including | 218.15 | 218.65 | 0.50 | 9.96 | |||

| and including | 220.30 | 222.55 | 2.25 | 9.39 | |||

| DL-048 | 416.30 | 420.20 | 3.90 | 18.09 | 1 | 342 | |

| including | 417.65 | 418.65 | 1.00 | 69.97 | |||

| and including | 417.65 | 420.20 | 2.55 | 27.57 | |||

| DHZ-045 | 67.35 | 67.85 | 0.50 | 2.36 | 1 | 62 | |

| and | 127.00 | 127.50 | 0.50 | 4.09 | 2 | 115 | |

| and | 156.00 | 156.50 | 0.50 | 3.25 | 3 | 141 | |

| and | 204.20 | 207.10 | 2.90 | 1.70 | 4 | 185 | |

| and | 225.20 | 233.80 | 8.60 | 3.15 | 5 | 207 | |

| DHZ-046 | 225.20 | 229.70 | 4.50 | 5.53 | 1 | 198 | |

| including | 229.20 | 229.70 | 0.50 | 37.32 | |||

| DHZ-047 | 265.50 | 266.00 | 0.50 | 3.21 | 1 | 247 | |

| DHZ-048 | 31.70 | 45.50 | 13.80 | 1.63 | 1 | 30 | |

| including | 39.80 | 45.50 | 5.70 | 2.39 | |||

| and including | 39.80 | 41.05 | 1.25 | 4.72 | |||

| and including | 43.50 | 46.00 | 2.50 | 3.21 | |||

| and including | 44.50 | 45.50 | 1.00 | 6.41 | |||

| and | 236.00 | 237.50 | 1.50 | 7.02 | 2 | 183 | |

| including | 237.00 | 237.50 | 0.50 | 20.40 | |||

| DHZ-049 | 38.30 | 46.90 | 8.60 | 2.39 | 1 | 35 | |

| and | 226.90 | 228.40 | 1.50 | 15.52 | 2 | 184 | |

| including | 227.90 | 228.40 | 0.50 | 44.94 | |||

| and | 243.00 | 243.50 | 0.50 | 4.68 | 3 | 197 |

* reported width is determined to be 90-95% of true width based on intersection points of the drill hole intercept with the geological model and oriented drill core data.

Figure 2: Rotated view looking to the southeast of the Hinge and Dixie Limb Zones showing multiple steeply-plunging gold mineralized zones that have been intersected to-date, flanking a central ultramafic-intruded fault. Drill hole DL-048 collared in the Dixie Limb Zone and continued across the Hinge Zone at depth. It is Great Bear’s deepest drill hole into the Hinge Zone mineralization to-date.

Chris Taylor continued, “The nearly universal pattern within gold deposits in the Red Lake district is of multiple steeply-plunging “ore shoots” developed along lithological and structural controls at variable depths, and our results at Dixie to-date suggest the same type of pattern may be present within the Hinge Zone vein swarm. We don’t yet know how many steeply-plunging sub-zones of gold mineralization are present, however we have already intersected 6 to 8 of them along 500 metres of strike length. We continue to drill aggressively on the known sub-zones and will continue to step out along strike and at depth in an attempt to discover how many there are, and to characterize their size, grade and continuity of gold endowment.”

Figure 3: View downwards towards the north of the same interpreted drill results data shown in Figure 1 and Figure 2.

About Great Bear

Great Bear Resources Ltd. (TSX-V: GBR) is a well-financed company based in Vancouver, Canada, managed by a team with a track record of success in the mineral exploration sector. Great Bear holds a 100% interest, royalty free, in its flagship Dixie property, which is road accessible year-round via Highway 105, a 15 minute drive from downtown Red Lake, Ontario. The Red Lake mining district is one of the premier mining districts in Canada, benefitting from major active mining operations including the Red Lake Gold Mine of Newmont Goldcorp Corp., plus modern infrastructure and a skilled workforce. Production from the Red Lake district does not necessarily reflect the mineralization that may, or may not be hosted on the Company’s Dixie property. The Dixie property covers a drill and geophysically defined multi kilometre gold mineralized system similar to that associated with other producing gold mines in the district. In addition, Great Bear is also earning a 100% royalty-free interest in the Pakwash, Dedee and Sobel properties, which cover regionally significant gold-controlling structures and prospective geology. All of Great Bear’s Red Lake projects are accessible year-round through existing roads.

Drill core is logged and sampled in a secure core storage facility located in Red Lake Ontario. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to SGS Canada Inc. in Red Lake, Ontario, and Activation Laboratories in Burnaby, British Columbia, both of which are accredited mineral analysis laboratories, for analysis. All samples are analysed for gold using standard Fire Assay-AA techniques. Samples returning over 10.0 g/t gold are analysed utilizing standard Fire Assay-Gravimetric methods. Selected samples with visible gold are also analyzed with a standard 1 kg metallic screen fire assay. Certified gold reference standards, blanks and field duplicates are routinely inserted into the sample stream, as part of Great Bear’s quality control/quality assurance program (QAQC). No QAQC issues were noted with the results reported herein.

Mr. R. Bob Singh, P.Geo, Director and VP Exploration, and Ms. Andrea Diakow P.Geo, Exploration Manager for Great Bear are the Qualified Persons as defined by National Instrument 43-101 responsible for the accuracy of technical information contained in this news release.

For further information please contact Mr. Chris Taylor, P.Geo, President and CEO at 604-646-8354, or Mr. Knox Henderson, Investor Relations, at 604-551-2360.

ON BEHALF OF THE BOARD

“Chris Taylor

Chris Taylor, President and CEO

Inquiries:

Tel: 604-646-8354

Fax: 604-646-4526

info@greatbearresources.ca

www.greatbearresources.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This new release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements.

We seek safe harbor