ValOre to Acquire the Pedra Branca PGM District in Brazil

Vancouver, B.C. ValOre Metals Corp. (TSX-V: VO) ("ValOre") today announced it has entered into an arm’s length, binding agreement (the "Agreement"), effective as of May 24, 2019, with Jangada Mines PLC ("Jangada") to purchase all of Jangada's Pedra Branca project ("Pedra Branca Project" or the "Project") through the purchase of 100% of Jangada’s shareholdings (the “Pedra Branca Shares”) in the Brazilian holding company Pedra Branca Brasil Mineracao Ltda (the "Acquisition").

Pedra Branca Platinum Group Metals District

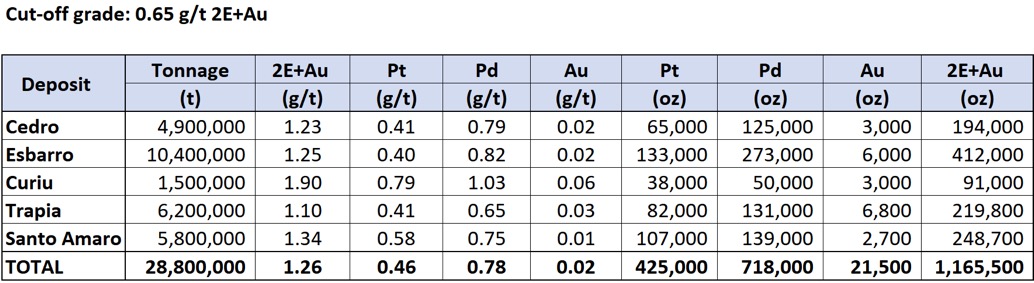

The Pedra Branca Project is a Platinum Group Metals (“PGM”) District located in north-eastern Brazil covering a total area of 38,940 hectares (96,223 acres) that comprises 38 exploration licenses. An independent National Instrument 43-101 resource estimate (the “Mineral Resources Estimates”) comprised of 5 distinct deposit areas hosts an inferred resource of 1,165,500 ounces PGM+Gold (Palladium, Platinum and Gold; Pd, Pt+Au) in 28.8 million tonnes (“Mt”) grading 1.26 grams PGM+Gold per tonne (“g PGM+Au/t”). PGM mineralization outcrops at surface and all of the inferred resources are potentially open pittable.

Jim Paterson, Chairman & CEO of ValOre, stated: “The exploration potential of the Pedra Branca Project from both a resource expansion and greenfields perspective is highly compelling, with numerous property-wide surface to near-surface, PGM targets. This Acquisition meets ValOre’s criteria in three key areas: high-value metal mineralization on a large scale; substantial project investments by previous operators; and obvious exploration strategies and process improvements which can be implemented by ValOre to add significant value to the project.”

The Pedra Branca Project is accessed by a national paved highway from the port city of Fortaleza (population approximately 3 million). The small town of Capitão Mor is situated within the west-central Project area, and provides all necessary basic infrastructure, including: energy, water, housing, office space, core storage and logging facilities, telephone access and internet. The Pedra Branca tenements are accessible throughout by a network of dirt roads and jeep tracks. Given the arid local climate and minimal annual rainfall, roadways remain in excellent shape year-round.

Material Terms of the Acquisition

In return for acquiring the Pedra Branca Shares, ValOre will give the following consideration to Jangada:

(a) issuance and allotment of 25,000,000 ValOre common shares ("Consideration Shares") on the date of closing of the Acquisition; and

(b) cash payments to Jangada in the aggregate of C$3,000,000, as follows:

(i) exclusivity payments totalling C$250,000 (paid);

(ii) C$750,000 payable on closing of the Acquisition;

(iii) C$1,000,000 on, or before, three (3) months after the closing of the Acquisition; and

(v) C$1,000,000 on, or before, six (6) months after the closing of the Acquisition.

The closing of the Acquisition is subject to conditions precedent which are normal for transactions of this nature, including necessary shareholder and regulatory approvals. The Acquisition is not subject to any finders fees.

Upon closing of the Acquisition, Jangada will have the right to appoint up to two (2) members to ValOre’s Board of Directors for a two (2) year term. The term may be extended if mutually agreed in writing by ValOre, Jangada and each of the nominee board members.

Private Placement

ValOre plans an equity financing of not less than C$3,000,000 (the "Financing") to fund transaction costs of the Acquisition, exploration expenditures on the Project and for general working capital. The terms of the Financing, and any potential advisory fees payable related to successfully completing the Financing and/or the closing of the Acquisition, will be determined in the context of the market and will be announced at a later date. Completion of the Financing is subject to acceptance by the TSX Venture Exchange.

Overview of the Pedra Branca NI 43-101 Inferred Resource

In conjunction with the acquisition of the Pedra Branca Project, ValOre commissioned Lions Gate Geological Consulting Inc. (“LGGC”) to prepare an inferred resource estimate and corresponding technical report (the "Technical Report") in compliance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). The Technical Report will be made available on SEDAR (www.SEDAR.com) along with other filing documents within 45 days of the issuance of this news release.

Notes:

- All mineral resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum (“CIM”) definitions, as required under NI 43-101.

- Mineral resources are reported in relation to a conceptual pit shell in order to demonstrate the potential for economic viability, as required under NI 43-101; mineralization lying outside of these pit shells is not reported as a mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability – see “Compliance with National Instrument 43-101” below. All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

- Mineral resources are reported at a cut-off grade of 0.65 g/t Pd+Pt+Au. Cut-off grades are based on metal prices of US$1,000, US$860 and US$1,250 per ounce of palladium, platinum and gold and a number of operating cost and recovery assumptions.

- An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

Cut-Off Grade and Prospects for Economic Extraction

The cut-off grades of 0.65 g/t combined palladium-platinum-gold (2PGE+Au) which is equivalent to a palladium, platinum and gold price assumptions of approximately US$1,000, US$860 and US$1,250/ounce, respectively, and based on cost estimates from similar projects. Prospects for eventual economic extraction of the mineral resources, as required by CIM definitions, were demonstrated by developing conceptual pit shells using a Lerchs-Grossman algorithm and input parameters derived from preliminary cost estimates associated with pre-feasibility level engineering studies, as outlined in the following table. Only mineral resources above the cut-off and within the mineral resource-limiting pits are reported; mineralization falling below this cut-off grade or outside the resource-limiting pits are not reported, no matter what the grade.

Palladium-Platinum-Gold Cut-off Grade Calculation Parameters

| Input Parameters | Units | Cost (US$) | Notes |

| Mining Cost - Resource | $/tonne mined | 1.50 | Includes mining G&A |

| Mining Cost – Waste | $/tonne mined | 1.50 | Includes mining G&A |

| Processing Cost | $/tonne mined | 13.50 | Includes G&A costs |

| Pd Recovery | % | 69 | |

| Pt Recovery | % | 68 | |

| Au Recovery | % | 40 | |

| Pit Slopes | degrees | 45 | |

| Pd Selling Price - Base Case | $/oz | 1,000 | |

| Pt Selling Price - Base Case | $/oz | 860 | |

| Au Selling Price - Base Case | $/oz | 1,250 | |

| Mining dilution | % | 0 | |

| Mining recovery | % | 100 |

Assumptions used to derive the cut-off grades and define the resource-limiting pits are estimated in order to meet the requirements defined by CIM for mineral resource estimates to demonstrate “reasonable prospects for eventual economic extraction”.

Mineral Resource Estimate Methodology

The mineral resource estimates for Pedra Blanca were prepared to industry standards and best practices using commercial mine-modeling and geostatistical software. Susan Lomas, P.Geo. is the Qualified Person responsible for the mineral resource estimates for the purposes of NI 43-101.

Each deposit was segregated into multiple estimation domains based on geologic models with the mineral resources estimated using inverse distance interpolation of capped composites. Search ellipse orientation and anisotropy were based on structural and geological controls.

Mineral resources were estimated using Giovia GEMS software.Grade domains based on 0.100 g/t 2PGE+Au grades were constructed within broad geological domains.Two-meter composites were calculated within the grade domains for each of the Santo Amaro, Curiu, Cedro, Esbarro and Trapia Deposits.Gold, platinum and palladium grades were capped where appropriate and sometimes a Restricted Outlier (RO) strategy was used during grade interpolation to allow high grades to be used locally but not impact distal blocks.

Grades were interpolated using Inverse Distance Squared (ID2) and Nearest Neighbour (NN) methods.For the Curiu, Cedro and Esbarro domains a minimum of 4 and maximum of 15 composites were used while at Trapia and Santo Amaro a minimum of 3 and maximum of 12 composites were used.In all cases a minimum of two drill holes were required for grade to be interpolated into a block.

Model validation included a visual inspection by sections and plans, global bias checks and local bias checks using swath plots.

A full description of the modeling methodologies for each deposit will be included in a technical report scheduled for release within 45 days.

Compliance with National Instrument 43-101

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., New Project Review for ValOre., and a Qualified Person.

Susan Lomas, P.Geo., of LGGC is the Qualified Person, as defined in NI 43-101, responsible for the mineral resource estimates as reported herein. She has read and approved the relevant technical portions of this news release related to the mineral resource estimates for which she is responsible.

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. These mineral resource estimates include inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

Forward Looking Statements

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

Certain statements within this news release, other than statements of historical fact relating to ValOre, are to be considered forward-looking statements with respect to the terms and the timing of the Acquisition, ValOre’s intentions for the Pedra Branca Project in Brazil, the exploration potential of the Pedra Branca Project, the timing of the filing of the Technical Report, the Mineral Resources Estimates, and the terms and timing of the proposed Financing. Forward-looking statements include statements that are predictive in nature, are reliant on future events or conditions, or include words such as "expects", "potential", "anticipates", "plans", "believes", "considers", "significant", "intends", "targets", "estimates", "seeks", attempts", "assumes", and other similar expressions.

The forward-looking statements are based on a number of assumptions which, while considered reasonable by ValOre, are, by their nature, subject to inherent risks and uncertainties and are not guarantees of future performance. Factors that could cause actual results to differ materially from those in forward-looking statements include: the receipt of and timing of any required approvals, the timing of the preparation of the Technical Report the interpretation of previous and current results, the accuracy of exploration results, the accuracy of Mineral Resource Estimates, the anticipated results of future exploration, the forgoing ability to finance further exploration, delays in the completion of exploration, the future prices of PGM and gold, and other metals, and general economic, market and/or business conditions. There can be no assurances that such statements and assumptions will prove accurate and, therefore, readers of this news release are advised to rely on their own evaluation of the information contained within.

Although ValOre has attempted to identify important risks, uncertainties and other factors that could cause actual performance, achievements, actions, events, results or conditions to differ materially from those expressed in or implied by the forward-looking statements, there may be other risks, uncertainties and other factors that cause future performance to differ from what is anticipated, estimated or intended. Unless otherwise indicated, forward-looking statements contained herein are as of the date hereof and ValOre does not assume any obligation to update any forward-looking statements after the date on which such statements were made, except as required by applicable law.