Great Bear Drills New “Gap” Zone: 16.80 g/t Gold Over 4.15 m and 1.25 g/t Gold Over 45.50 m; Auro Zone Drilling Intersects 241.88 g/t Gold Over 1.20 m Within 48.67 g/t Gold Over 8.70 m

December 16, 2019 – Vancouver, British Columbia, Canada – Great Bear Resources Ltd. (the “Company” or “Great Bear”, TSX-V: GBR) today reported new results from its fully-funded 200,000 metre drill program at its 100% owned Dixie project in the Red Lake district of Ontario. Results are from the following zones along the LP Fault target: “Gap” (new), Auro and Bear-Rimini. Highlights of recent results include:

- 16.80 g/t gold over 4.15 metres (from 55.00 to 59.15 metres), and a separate interval of 1.25 g/t gold over 45.50 metres (from 125.25 to 170.80 metres) in the new Gap zone, located between the Bear-Rimini and Yuma zones.

- 48.67 g/t gold over 8.70 metres (from 251.60 to 260.30 metres), including 241.88 g/t gold over 1.20 metres in the Auro zone.

- 1.13 g/t gold over 41.80 metres (from 217.70 to 259.50 metres), which includes 6.69 g/t gold over 3.50 metres, and 1.13 g/t gold over 37.95 metres (from 264.60 to 302.55 metres) in the Bear-Rimini zone.

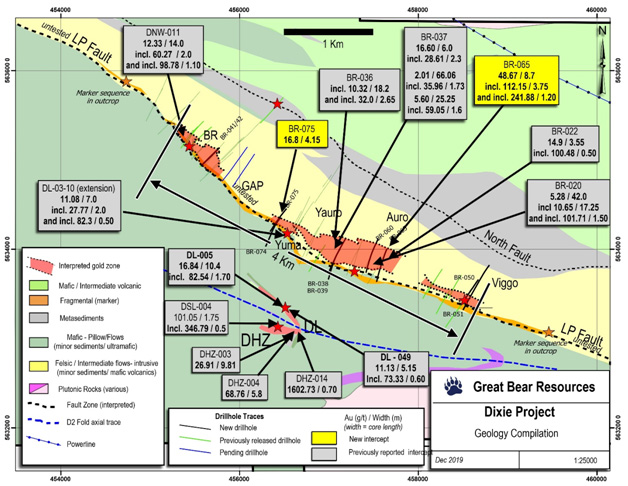

Chris Taylor, President and CEO of Great Bear said, “With the discovery of high-grade gold mineralization in the new Gap area, the last significant undrilled segment of the LP Fault between the Bear-Rimini and Viggo zones is being successfully filled. Remarkably, all (100%) of the drill holes completed into the LP Fault structure to-date have intersected similar gold mineralization and host geology. Results continue to support continuity of gold mineralization along more than 4 kilometres, which remains open along strike and at depth. Our drilling strategy for 2020 is threefold: 1) We plan to continue the discovery process through drill-testing of new targets across the project, 2) we plan to continue significant step-out drilling over 12 kilometres of the 18 kilometre LP Fault, and 3) we will undertake concurrent closely spaced drilling in areas where we have already successfully intersected gold.”

The Company also announces that details regarding a previously announced two percent Net Smelter Royalty (“NSR”) spinout to its shareholders will be provided in January 2020.

The New Gap Zone:

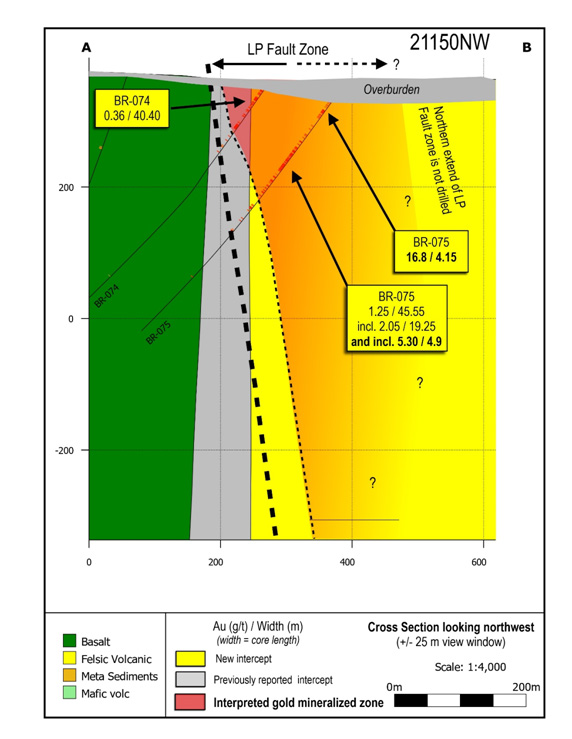

- Discovery hole BR-075 was completed between the Bear-Rimini and Yuma zones within an approximately one kilometre long previously undrilled gap (the Gap zone) in drilling and intersected 16.80 g/t gold over 4.15 metres, and 1.25 g/t gold over 45.5 metres. Gold was hosted by on-strike extensions of the felsic volcanic geology and quartz-sericite-albite alteration seen in the adjacent zones.

- BR-075 is located on a 200 metre step-out to the northwest from the nearest drilling in the Yuma zone, and a 750 metre step-out to the southeast from the nearest drilling with results in the Bear-Rimini zone. As this hole was collared within the LP Fault zone and drilled to the southwest, the northern boundary of the LP Fault zone has not yet been intersected, and additional drilling will be required to determine the overall thickness of gold mineralization in this area. A map of updated drilling is provided in Figure 1 and a cross section through the Gap zone in the area of BR-075 is provided in Figure 2.

- The Gap zone is situated in what was the only remaining significant (approximately 1 kilometre) undrilled segment of the 4 kilometres of the LP Fault tested to-date. While separate zone names are provided by Great Bear for communication purposes, results to-date suggest gold mineralization and host geology are continuous along the four kilometres of the LP Fault drilled thus far.

- Drill hole BR-074 was drilled on the same section as discovery hole BR-075, but was located too close to the southern margin of the LP Fault zone and intersected only the wide lower grade gold mineralization typical of the zone’s margins, assaying 0.36 g/t gold over 40.40 metres (see Figure 2).

Auro Zone Results:

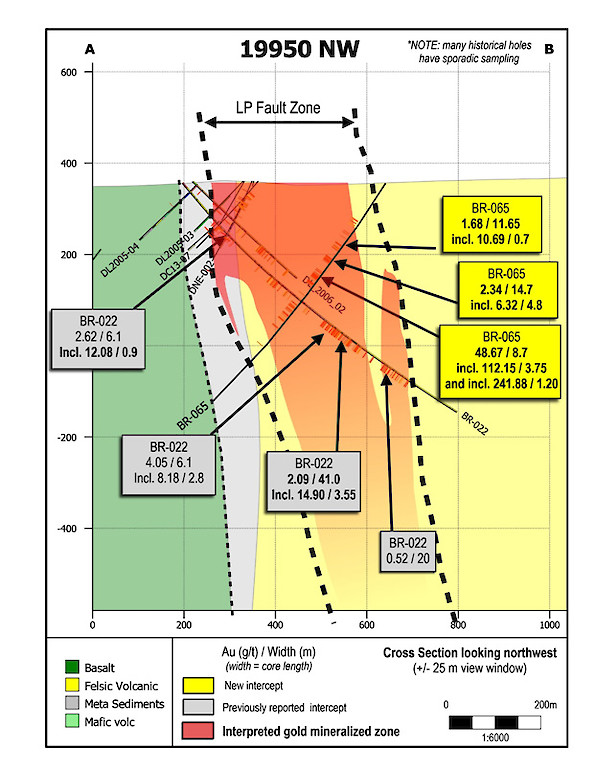

- One of the best holes drilled to-date at the Dixie project has been completed in the Auro zone. Drill hole BR-065 assayed 48.67 g/t gold over 8.70 metres, including 241.88 g/t gold over 1.20 metres. A cross section is provided in Figure 3 and images of high-grade visible gold are provided in Figure 4.

- BR-065 is located 188 metres to the southeast of Auro zone drill hole BR-020 which yielded 10.65 g/t gold over 17.25 m, within a wider interval of 5.28 g/t gold over 42.0 metres, as originally reported on September 3, 2019, and 155 metres up-dip of the mineralized interval of drill hole BR-022 which assayed 14.9 g/t gold over 3.55 metres.

- Once again, Great Bear’s field crews have found favorable alteration, geology, mineralization and visible gold undocumented and un-assayed in historical drill core from the LP Fault zone, this time in drill hole DL-2006-01 from the Auro area. Drill core had been cross-piled in storage on the property for 13 years. See Figure 5. Assay results from historical drill hole DL-2006-01 are pending.

Bear-Rimini Zone Results:

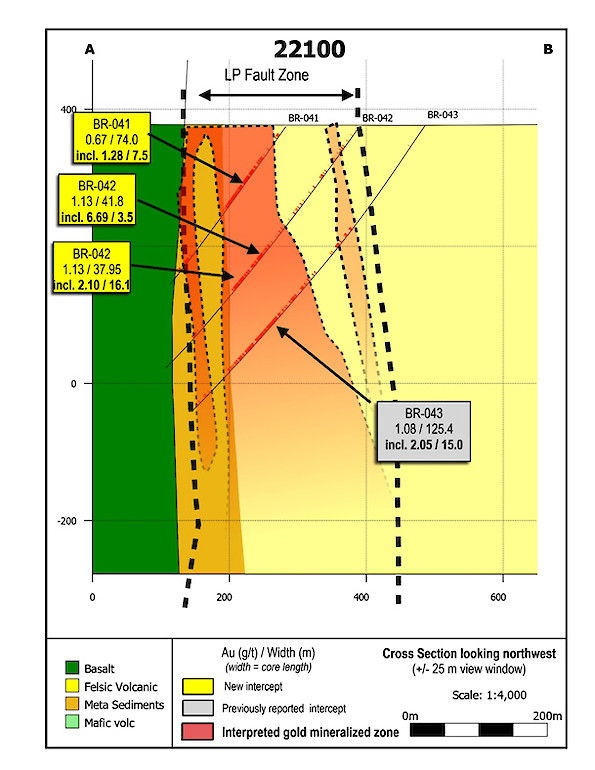

- Drill holes BR-041 and BR-042 were completed within the Bear-Rimini zone. Mineralized intervals were intersected 200 metres and 75 metres, respectively, vertically above the mineralized interval in drill hole BR-043, which intersected 125.4 metres of 1.08 g/t gold as was originally reported by the Company on October 10, 2019. A cross section is provided in Figure 6.

- Drill hole BR-042 intersected 1.13 g/t gold over 41.80 metres, including 6.69 g/t gold over 3.50 metres, and a second interval (separated from the previous interval by a 5.10 metre unmineralized gap) of 1.13 g/t gold over 37.95 metres.

- Drill hole BR-041 intersected a number of zones: 0.66 g/t gold over 10.00 metres, 0.67 g/t gold over 74.00 metres, and 1.05 g/t gold over 4.50 metres.

- This drill section has defined a zone of continuous mineralization from the near-surface to approximately 400 metres vertical depth.

- As observed at many locations along the LP Fault, the apparent thickness and strength of gold mineralization increases with depth and remains open to extension.

Additional drill holes have also now been completed further along the projected strike of the LP Fault zone and within the Gap zone from which assays are pending and will be released in the new year. Great Bear plans to drill test approximately 12 kilometres of the 18 kilometre long LP Fault target during 2020.

Figure 1: Map of current drill results at the Dixie property

Table 1: Most recent results from drilling along 4 kilometres of the LP Fault target.

| Drill Hole | From (m) | To (m) | Width* (m) | Gold (g/t) | Section | Area | |

|---|---|---|---|---|---|---|---|

| BR-038 | 48.70 | 92.80 | 44.10 | 0.68 | 20400 | Auro | |

| including | 75.25 | 92.80 | 17.55 | 1.51 | |||

| and including | 81.20 | 91.80 | 10.60 | 2.06 | |||

| 104.50 | 112.00 | 7.50 | 1.05 | ||||

| and | 264.10 | 266.20 | 2.10 | 1.12 | |||

| and | 290.70 | 304.00 | 13.30 | 0.44 | |||

| and | 325.70 | 336.10 | 10.40 | 1.35 | |||

| and | 415.00 | 436.00 | 21.00 | 0.24 | |||

| and | 480.45 | 482.45 | 2.00 | 4.90 | |||

| BR-039 | 40.00 | 43.00 | 3.00 | 3.23 | 20400 | Auro | |

| and | 115.80 | 154.30 | 38.50 | 0.43 | |||

| and | 162.50 | 181.25 | 18.75 | 0.44 | |||

| and | 262.00 | 277.65 | 15.65 | 0.83 | |||

| BR-041 | 58.00 | 68.00 | 10.00 | 0.66 | 22100 | BR | |

| and | 72.60 | 146.60 | 74.00 | 0.67 | |||

| including | 107.00 | 114.50 | 7.50 | 1.28 | |||

| and | 243.00 | 247.50 | 4.50 | 1.05 | |||

| BR-042 | 217.70 | 259.50 | 41.80 | 1.13 | 22100 | BR | |

| including | 217.70 | 221.20 | 3.50 | 6.69 | |||

| and | 264.60 | 302.55 | 37.95 | 1.13 | |||

| including | 277.20 | 293.30 | 16.10 | 2.10 | |||

| BR-047 | 195.20 | 226.75 | 31.55 | 0.54 | 21900 | BR | |

| and | 293.10 | 311.70 | 18.60 | 0.31 | |||

| and | 324.00 | 337.85 | 13.85 | 0.29 | |||

| BR-060 | 140.35 | 154.00 | 13.65 | 0.12 | 20100 | Auro | |

| and | 244.00 | 276.00 | 32.00 | 0.31 | |||

| and | 284.00 | 333.00 | 49.00 | 1.74 | |||

| including | 295.00 | 311.00 | 16.00 | 3.82 | |||

| and including | 302.00 | 311.00 | 9.00 | 6.30 | |||

| and including | 306.70 | 311.00 | 4.30 | 11.95 | |||

| and | 417.60 | 418.70 | 1.10 | 3.52 | |||

| BR-065 | 145.00 | 148.00 | 3.00 | 1.79 | 19850 | Auro | |

| and | 152.60 | 160.60 | 8.00 | 0.79 | |||

| and | 182.35 | 194.00 | 11.65 | 1.68 | |||

| and | 186.80 | 187.50 | 0.70 | 10.69 | |||

| and | 228.70 | 243.40 | 14.70 | 2.34 | |||

| including | 236.40 | 241.20 | 4.80 | 6.32 | |||

| and | 251.60 | 260.30 | 8.70 | 48.67 | |||

| including | 252.55 | 256.90 | 4.35 | 97.00 | |||

| and including | 252.55 | 256.30 | 3.75 | 112.15 | |||

| and including | 253.60 | 254.80 | 1.20 | 241.88 | |||

| and | 380.80 | 384.40 | 3.60 | 1.17 | |||

| including | 382.10 | 383.10 | 1.00 | 3.65 | |||

| BR-074 | 16.60 | 57.00 | 40.40 | 0.36 | 21150 | Gap | |

| and | 80.00 | 88.60 | 8.60 | 0.53 | |||

| BR-075 | 55.00 | 59.15 | 4.15 | 16.80 | 21150 | Gap | |

| and | 125.25 | 170.80 | 45.55 | 1.25 | |||

| including | 132.25 | 151.50 | 19.25 | 2.05 | |||

| and including | 139.25 | 144.15 | 4.90 | 5.30 |

*Widths are drill indicated core length, as insufficient drilling has been undertaken to determine true widths at this time. Average grades are calculated with un-capped gold assays, as insufficient drilling has been completed to determine capping levels for higher grade gold intercepts. Average widths are calculated using a 0.10 g/t gold cut-off grade with < 3 m of internal dilution of zero grade.

Figure 2: Cross section 21150 looking northwest, the first drill section completed into the Gap zone.

Figure 3: Cross section 19950 looking northwest; showing the most recent Auro zone drill results.

Figure 4: Example of high-grade disseminated visible gold mineralization from Auro drill hole BR-065.

The photos are of selected intervals and are not representative of the mineralization hosted on the property

Figure 5: Historical drill core from drill hole DL-2006-01 which yielded historically un-assayed visible gold in the Auro zone.

Figure 6: Cross section 22100 looking northwest showing the most recent drill results from the Bear-Rimini zone.

ABOUT THE DIXIE PROJECT

The Dixie Project is 100% owned, and consists of 9,140 hectares of contiguous claims that extend over 22 kilometres, and is located approximately 25 kilometres southeast of the town of Red Lake (15minute drive), Ontario. The project is accessible year-round via a paved highway (which runs the length of the northern claim boundary) and a network of well-maintained logging roads.

The Dixie property hosts two principle styles of gold mineralization:

- High-grade gold in quartz veins and silica-sulphide replacement zones (Dixie Limb and Hinge). Hosted by mafic volcanic rocks, and localized near regional-scale D2 fold axes. These mineralization styles are also typical of the significant mined deposits of the Red Lake district.

- High-grade disseminated gold with broad moderate to lower grade envelopes (LP Fault). Interpreted to traverse the Dixie property for approximately 18 kilometres of strike length and currently drilled along 4 kilometres of strike length. High-grade gold mineralization is controlled by structural and geological contacts, and moderate to lower-grade disseminated gold surrounds and flanks the high-grade intervals. The dominant gold-hosting stratigraphy consists of felsic sediments and volcanic units.

About Great Bear

Great Bear Resources Ltd. is a well-financed gold exploration company managed by a team with a track record of success in mineral exploration. Great Bear is focused in the prolific Red Lake gold district in northwest Ontario, where the company controls over 300 km2 of highly prospective tenure across 4 projects: the flagship Dixie Project (100% owned), and the Pakwash Property (earning a 100% interest), the Dedee Property (earning a 100% interest), and the Sobel Property (earning a 100% interest), all of which are accessible year-round through existing roads.

QA/QC and Core Sampling Protocols

Drill core is logged and sampled in a secure core storage facility located in Red Lake Ontario. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to SGS Canada Inc. in Red Lake, Ontario, and Activation Laboratories in Ontario, both of which are accredited mineral analysis laboratories, for analysis. All samples are analysed for gold using standard Fire Assay-AA techniques. Samples returning over 10.0 g/t gold are analysed utilizing standard Fire Assay-Gravimetric methods. Pulps from approximately 5% of the gold mineralized samples are submitted for check analysis to a second lab. Selected samples are also chosen for duplicate assay from the coarse reject of the original sample. Selected samples with visible gold are also analyzed with a standard 1 kg metallic screen fire assay. Certified gold reference standards, blanks and field duplicates are routinely inserted into the sample stream, as part of Great Bear’s quality control/quality assurance program (QAQC). No QAQC issues were noted with the results reported herein. Drill hole location information is provided below:

| Drill Hole | Easting | Northing | Elevation (m) | Dip | Azimuth |

|---|---|---|---|---|---|

| BR-038 | 457154 | 5634131 | 355.94 | -52.9 | 213 |

| BR-039 | 457088 | 5634011 | 357.85 | -53.3 | 212 |

| BR-041 | 455693 | 5635045 | 374.70 | -55.3 | 225 |

| BR-042 | 455768 | 5635123 | 374.73 | -55.0 | 225 |

| BR-047 | 455754 | 5634703 | 373.62 | -52.0 | 39 |

| BR-060 | 457508 | 5634126 | 359.90 | -58.4 | 209 |

| BR-065 | 457602 | 5634013 | 352.88 | -55.2 | 205 |

| BR-074 | 456439 | 5634357 | 359.41 | -55.3 | 220 |

| BR-075 | 456503 | 5634455 | 360.31 | -55.0 | 220 |

Qualified Person and NI 43-101 Disclosure

Mr. R. Bob Singh, P.Geo, Director and VP Exploration, and Ms. Andrea Diakow P.Geo, Exploration Manager for Great Bear are the Qualified Persons as defined by National Instrument 43-101 responsible for the accuracy of technical information contained in this news release.

ON BEHALF OF THE BOARD

“Chris Taylor”

Chris Taylor, President and CEO

Investor Inquiries:

Mr. Knox Henderson

Tel: 604-551-2360

Fax: 604-646-4526

info@greatbearresources.ca

www.greatbearresources.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This new release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements.

We seek safe harbor