Breaking the Overseas Grip: The Urgent Case for Rare Earth Mining in North America

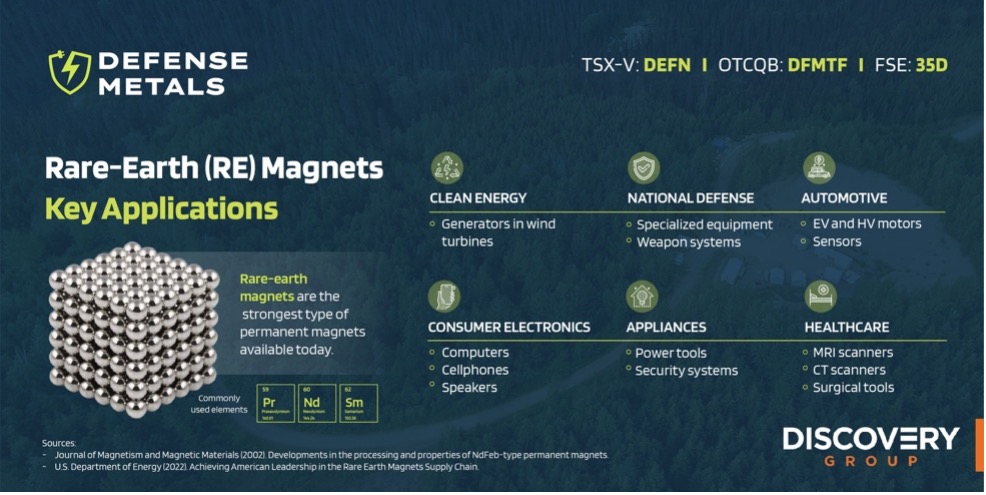

Rare earth elements consist of a group of 17 chemical elements whose properties make them indispensable for use in modern, high-tech applications. Today, they are mostly used in permanent magnets, which have a wide variety of applications, from electronics to equipment for national defense and clean energy.

Figure 1: Rare Earth Magnets Key Applications

Since the 1990s, China has dominated global rare earth production, mining roughly 95% of the world's total output by the early 2000s. Starting in 2006, the nation implemented a series of regulations encompassing export quotas, production quotas, export taxes, and limitations on foreign investment. While export quotas were incrementally introduced, a significant shift occurred in 2010 when China reduced its export quota for rare earths by 37%, triggering a sharp increase in rare earth oxide prices due to the absence of alternative supplies.

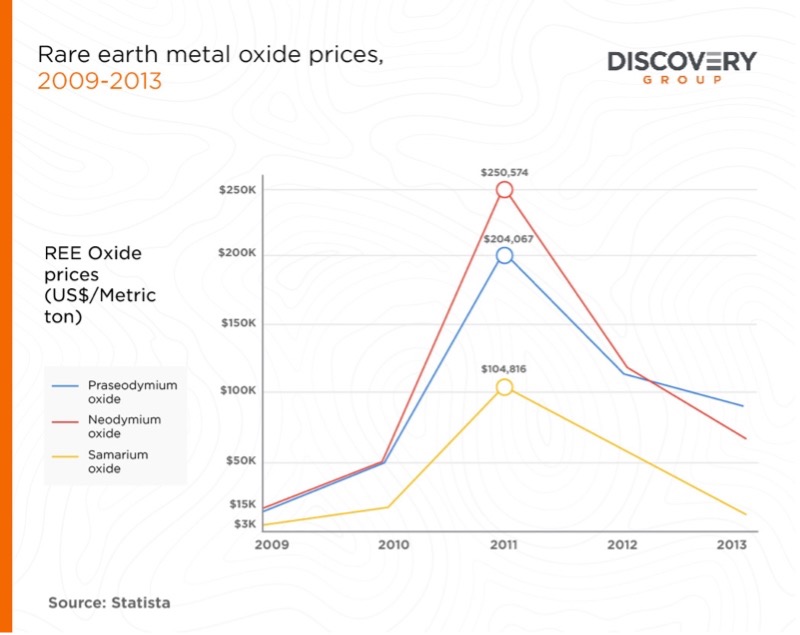

Figure 2: Rare Earth Metal Oxide Prices - 2009 to 2013

The price for praseodymium oxide, neodymium oxide, and samarium oxides jumped up to 366% from 2009 to 2010 and up to 555% from 2010 to 2011.

These price spikes caused major shifts in the supply and demand dynamics for these elements. Nations were forced to reduce their REE demand by recycling and substitution while scrambling to increase supply through trade redirection, inventory optimization, accelerating the inauguration of new mines, and even illicit smuggling activities from China.

In March of 2012, Japan, the European Union, and the United States jointly initiated a World Trade Organization consultation regarding China's restrictions on rare earth exports. China denies violating the W.T.O. ban on export restrictions, saying that it qualified for an exception for environmental protection and conservation of natural resources. China asserted that these restrictions were vital to conserve supplies for its own high-tech and green energy industries. However, the opposing parties argued that these measures primarily served industrial policy goals rather than resource conservation. Ultimately, the World Trade Organization Appellate Body ruled in favor of the complainants, mandating that China lift its rare earth export restrictions.

As of 2023, China continues to hold the title of the largest producer of rare earth elements, accounting for 70% of global production. According to the US Geological Survey, the United States ranks second with 12% of the market share, followed by Burma with 10.8%.

With only one REE mine operating in North America (MP Material’s Mountain Pass Mine in California), the governments of the US and Canada have signed agreements to accelerate the development of a mine-to-magnet domestic supply chain. Since 2020, the Department of Defense has granted more than US$439 million to separate and refine rare earth elements mined in the U.S., as well as develop downstream processes needed to convert those refined materials into metals and then magnets.

Biden and Trudeau’s administrations are also reviewing funding opportunities for REE exploration projects, such as Defense Metal’s Wicheeda deposit in British Columbia. Wicheeda’s current neodymium mineral resource estimates can produce enough magnets to create one of the following possibilities:

- 8,065 Wind turbines*

- 1,531,487 Virginia-class submarines

- 2,688,172 Electric vehicles

- 15,305,043 F-35 jets

- 32,258,065 Inverter air conditioners

*Assuming a wind turbine requires 250–650 kg of NdFeB magnet to produce 1MW electrical energy and the average size of onshore turbine is around 2.5-3 MW and average size of offshore wind turbine is 3.6 MW

The volatile history of rare earth elements underscores the urgent need for North America to establish a robust domestic supply chain. The risk of another price surge, potentially reaching a staggering 500%, looms large in a market still heavily influenced by China's dominance. The Biden and Trudeau administrations' efforts to expedite the development of rare earth mining and processing facilities signal a recognition of the strategic importance of securing a local source for these critical materials.

Now is the time to prioritize investments in rare earth exploration and processing, ensuring a stable and sustainable future for applications reliant on these indispensable elements.