Critical Minerals: Identifying Supply Risks & Investment Opportunities

Critical metals play a vital role in modern society, making developing and securing a sustainable supply chain a priority for many countries, including the United States and Canada. Rare earth elements, copper, zinc, tungsten, nickel, palladium, and other minerals are essential components in the production of clean technologies, electronics, aerospace and military equipment, healthcare machinery and agricultural equipment.

As demand for these industries grows, so does the potential for substantial returns on these metal’s exploration and mining stocks. In this article, we present a list of supply risks that investors should keep an eye on in order to maximize returns.

Figure 1 – Main Geopolitical Factors that Affect the Supply of Critical Minerals

1. External Shocks

Recently, the global critical metals supply chain has been disrupted by two big shocks: the COVID-19 pandemic and the war in Ukraine. Other examples of external shocks that can affect their supply chains are natural disasters, such as earthquakes and hurricanes.

Despite seeming unpredictable at first, investors can mitigate the risks of armed conflicts by picking companies with projects in politically stable jurisdictions – such as Canada, the U.S., Australia, Brazil, and Sweden. The same can be done with earthquakes and tsunamis since those tend to happen more often in regions close to the edge of tectonic plates – such as Peru, Chile, and the Philippines.

2. Resource Nationalism

It is not uncommon for the governments of big mining countries - such as Mongolia, Namibia, Peru, and South Africa – to impose measures to increase state control over their vast mineral resources. Policies around royalty renegotiation, increase in taxation, nationalization of critical metals companies, and restrictions on foreign investment have been used in the past as a way to increase government revenues. Potential increases in costs and/or changes in access rights over natural resources can impact the price of mining stocks greatly.

3. Export Restrictions

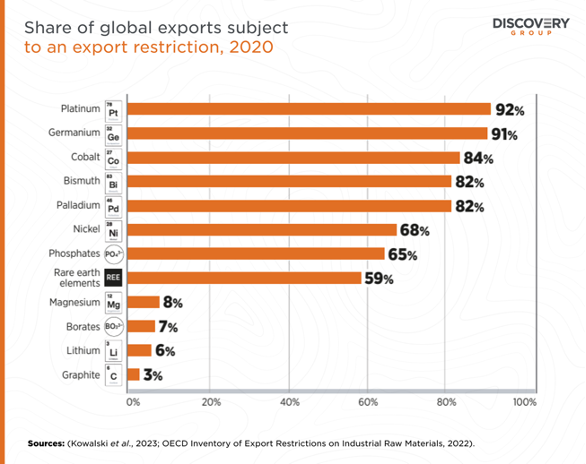

According to the Organization for Economic Cooperation and Development (OECD), export restrictions on raw materials have increased more than five times in the last decade. Around 10% of the global value of critical raw material exports has faced at least one export restriction measure in recent years. This includes various forms such as export quotas, export taxes, obligatory minimum export prices, or licensing.

Figure 2 - Metals Subject to an Export Restriction, 2020

4. Mineral Cartels

High mineral production from only a few countries raises concerns about market cartelization and collusion. The geographical concentration of mineral supply allows companies with significant market shares in key segments of mineral value chains to dominate mining and refinement. This production concentration may result in the formation of commodity cartels, where major producers cooperate on commodity production, pricing, and distribution to maximize profits.

5. Political Instability and Social Unrest

Political or social unrest such as coups, labour strikes and civil wars in mining countries have disrupted the mineral supply in the past decades. The majority of mineral extraction occurs within countries categorized as either “extremely unstable” or “unstable” in the Worldwide Governance Indicators.

The recent military coup in Gabon - the world’s second-largest producer of manganese - is the eighth coup in West and Central Africa in the past three years, following government overthrows in Burkina Faso, Chad, Guinea, Mali, Niger, and Sudan. This situation highlights the risk of investing in mineral-rich African countries where ongoing political instability continues to block economic development.

6. Market volatility and manipulation

In addition to supply and demand factors, mineral and metal markets face susceptibility to market manipulation, intensifying price volatility and supply chain disruptions. Between 2000 and 2010, antitrust authorities uncovered and penalized at least 15 attempts to establish international private cartels in mining and primary metals.

More recently, the London Metal Exchange (LME) halted nickel trading in March 2022 after prices surged over 250% in two days, which was attributed to a short squeeze. The nickel market remains unstable over a year later, with plummeting trading volumes and frequent unpredictable price swings.

These incidents have prompted financial regulators and exchanges to initiate probes for increased market oversight, transparency, and risk management. However, the actual effectiveness of these efforts in preventing market manipulation is yet to be determined.

Despite many supply risks, investing in critical metals remains an enticing prospect for investors seeking substantial returns. For people exploring this sector, strategic decision-making that incorporates geopolitical insights and market dynamics is essential for maximizing profits.